Since the early days, Management Accounting has played a critical role in helping executives to make impactful decisions. However, many people have easily mistaken Management Accounting for "Financial Accounting." When you clearly understand these two concepts, you will see that they have obvious fundamental differences.

Read more: An accounting software playbook

Management accounting (also known as managerial accounting) examines the events occurring in and around the business while considering the needs of the whole organisation.

According to the Institute of Management Accountants, Management Accounting requires collaboration in decision making, performance planning/management, and provides expertise in financial reporting and auditing, as well as assisting management levels in the development and implementation of the organisation's strategy.

The Chartered Institute of Management Accountants (CMIA) described Management Accounting as an information analysing tool to support business strategies and promote sustainable growth. In Management Accounting, managers use accounting information to better inform themselves before deciding on the issues in their organisation, helping to manage and implement the control functions.

In the past, there was rarely any change in the practice of Management Accounting despite the radical changes in the business environment. Therefore, accounting institutions were encouraged to apply market practice to the accounting theory. Since 1993, professional accounting institutes have begun to devote more resources to the development of Management Accounting.

Read more: Accounting Software for Nonprofits: a Case Study of Infor SunSystems

Management Accounting is applied in various industries. The specific functions and rules may vary by industry. In details, it is actually extended to the following three areas:

As the Institute of Certified Management Accountants (CMA) stated: "A management accountant applies their knowledge and expertise in preparing and presenting financial information and decisions to support in policy formulation and control of commitments."

Financial and Management Accounting are both important tools for business but serve different purposes. Businesses use accounting to determine future action plans and review past and current performance. The investors are not involved in the day-to-day business operations but are concerned about their investments, while managers need the information to quickly make daily business decisions, which leads to the fact that Managerial and Financial Accounting have different subjects.

Specifically, Financial Accounting is used to present the financial health of an organisation to its external stakeholders. Directors, shareholders, financial institutions and other investors are the subjects of the financial accounting reports. Financial Accounting presents a specific time period in the past and allows the readers to see how the enterprise has performed.

On the other hand, Management Accounting is used by managers to make decisions related to day-to-day operations. It's not based on performance in the past, but on the current and future trends, which may not yield accurate numbers and figures. Because managers usually need to make decisions in a short period of time in an uncertain environment, management accounting relies heavily on market forecasts and trends.

The main differences between Management Accounting and Financial Accounting can be summarised in this article.

In today’s ‘VUCA’ world—characterised by volatility, uncertainty, complexity and ambiguity— it is becoming harder and harder to get right. As discontinuity becomes the norm and the most established business models come under threat, business leaders may need to adapt their models or develop new ones.

Globalisation, technological development and rapid population growth are causing fundamental change to the business world. Traditional financial reporting has not kept pace with the seismic shift in macro-economic value experienced over the last 30 years, and this is reflected in balance sheets.

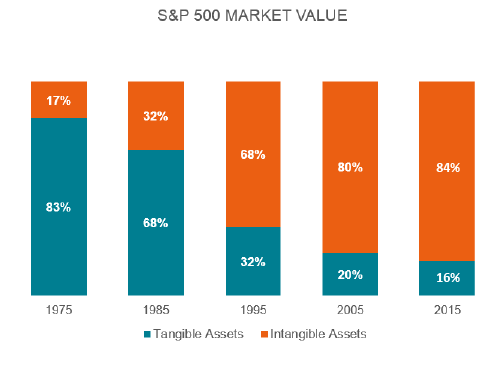

A study by the consulting firm Ocean Tomo concludes that intangible assets now make up more than 80% of S&P 500 market value, up from less than 20% in 1975. Another research from McKinsey finds 31% of Western companies’ profit comes from these “asset-light, idea-intensive sectors”, compared with 17% in 1999.

The following chart highlights the changing roles of tangible and intangible assets in terms of market value over time.

Reporting must evolve to address the information needs of business decision-makers within this changing business dynamic. The focus has to be on disclosing not just a broader set of information but the relevant and interconnected information needed by investors, employees and other stakeholders. As a result, management accounting is essential to achieve sustainable success in a constantly changing environment.

Additionally, the large majority of senior business leaders find themselves battling against bureaucratic decision-making processes, siloed and short-term thinking, breakdowns in trust and collaboration inside the organisation and difficulties with translating ever-expanding volumes of information into relevant knowledge.

Businesses, no matter how big or small, all want to make high quality, impactful business decisions. In order to be able to do so, the business must be equipped with accurate, fact-based and timely data. This is where management accounting comes in.

Implementing global management accounting principlescan offer a solution to these challenges. An effective management accounting system helps organisations:

Management accounting lies at the heart of the organisation, combining businesses’ two most crucial elements: finance and management. A study reveals that 47% of CFOs currently working in Asia acknowledge the challenges and consequences cause by overwhelming data volume. By 2020, the number of online business transactions is estimated to surpass 450 billion per day.

Management accounting empowers the stakeholders to make impactful decisions on the business' future with value and insights instead of randomly compiled figures.

However, each organisation has its own way of manoeuvring around the management accounting software. Therefore, the American Institute of CPAs (AICPA) and Chartered Institute of Management Accountants (CIMA) proposed the four core principles for management accounting which can be applied to any business regardless of size, and regardless of geographical location.

The Global Management Principles are created to guide CFOs, CEOs and the boards of directors in their management accounting practice, to help them respond faster to risks, to protect their market value, and of course, to make better decisions.

In order to pinpoint the factors that make up the Principles, CIMA and the AICPA conducted intensive research that span across 20 countries in 5 continents. More than 400 participants had joined the 90-day consultation period. These participants were representing all sorts of businesses and industries; this is to ensure the universal applicability of the Principles.

Read more: Factors to consider when choosing accounting software

For management accounting to function effectively, it requires skilled and competent personnel. These professionals would apply the Principles into their daily operations to maintain the integrity of the businesses whilst utilise the insights provided to nurture growth.

The four core principles of global management accounting are:

The following special reports by CIMA (Chartered Institute of Management Accountants) and the AICPA (American Institute of Certified Public Accountants) can be the starting point for the adoption of the global management accounting principles.

How can organisations make good strategic decisions quickly—and then deliver on their choices. Download the full report.

At a time when many of the practices and processes that account for a company’s assets do not adequately capture value, we urgently require a reality check for business reporting. Download the full report.

The human dimension – relationships with customers, employees, partners and communities – will be key to getting things moving again and sustaining success over the long run. Download the full report.

As chartered management accountants, CIMA members throughout the world have a duty to observe the highest standards of conduct and integrity and to uphold the good standing and reputation of the profession.

They must also refrain from any conduct which might discredit the profession. Members and registered students must have regard to these guidelines irrespective of their field of activity, of their contract of employment or of any other professional memberships they may hold.

The CIMA code of ethics is based on the IFAC handbook of the code of ethics for professional accountants, from the International Ethics Standards Board of Accountants (IESBA).

The CIMA code of ethics is made up of five fundamental principles:

Interested in learning more?

Subscribe to TRG Blog dedicated to Finance professionals to always keep up-to-date on the latest news, trends, and events occurring Vietnam as well as around the world.

To subscribe, simply fill out the form on your right hand side!

Security is a major concern in our industry. Using Infor solutions was instrumental in ensuring we were delivering features with a high level of security and data privacy.

Howard Phung Fraser Hospitality Australia

TRG provides us with high-level support and industry knowledge and experience. There are challenges and roadblocks but it's certainly a collaboration and partnership that will see us be successful at the end.

Archie Natividad Aman Resorts

IT, Talent and F&B - we think it's a great combination.

We've thrived since 1994 resulting in lots of experience to share, we are beyond a companion, to more than 1,000 clients in 80+ countries.

© 2023 TRG International. Privacy Policy / Тerms & Conditions / Site map / Contact Us

TRG encourages websites and blogs to link to its web pages. Articles may be republished without alteration with the attribution statement "This article was first published by TRG International (www.trginternational.com)" and a clickable link back to the website.

We are changing support for TLS 1.0 and older browsers. Please check our list of supported browsers.