Companies are adopting innovative enterprise solutions to help them stay ahead of their competitors. Nevertheless, many still rely on spreadsheets to perform vital financial functions. It is not a promising way for companies to remain relevant in this new digital economy.

One inherent drawback of spreadsheets is that they rely on manual input processes, and hence, are error-prone. If an error is made, there are few effective ways to detect and track that error. Once the data is rolled up, top executives can hardly drill down the numbers to the details. Using spreadsheets also creates a system of fragmented data and does not facilitate quick action.

A typical spreadsheet-based system can take up to 30 days or more to complete a consolidation. It leaves you with very little time to do any useful analysis. Moreover, spreadsheet-based data normally enables backwards-looking analytics only, not the kind of forward-looking information that companies need.

Furthermore, if you have businesses across multiple locations, intercompany accounting is challenging and time-consuming without a proper system in place.

It is often hard to tell which accounting software is better than another, yet somehow the most suitable solution must still be found. Making the right choice can be divided into three aspects: your business, the software, and the software vendor. Here are the various factors to consider when choosing an accounting software.

Accounting software should have a user-friendly interface for your staff to navigate. Complex systems that require extensive training can result in loss of productivity, data entry errors, and staff frustration.

Choosing accounting software that can scale and adapt to your business' needs is essential. Many organisations make the detrimental mistake of choosing software that only serves their current requirements, and as their businesses grow, they end up migrating to another software, which can be a costly and resource-consuming process.

Financial data is very sensitive, and any errors or inaccuracies can cause major problems, including legal issues and a loss of credibility with stakeholders. Therefore, businesses should seriously examine integrity by comparing built-in security, data validation controls, and audit trail features among different accounting software packages before purchasing one. This will ensure a more transparent accounting process, thus preventing unauthorised access and fraudulent activities during the software implementation.

Accounting software with robust management capabilities helps businesses gain a more comprehensive understanding of their current financial situation, enabling proactive financial planning for the future, an informed decision-making process, and taking steps to improve financial health and performance.

With the increasing trend of remote work and the emerging need for a flexible workflow, accounting software should provide users with convenient access regardless of their location or device. Besides, advanced access control features are also critical for accounting software to ensure that only employees and stakeholders have permission to access this sensitive financial data.

Cyberattacks are one of the most profound threats to the growth of any business. Since your accounting software will contain a lot of sensitive financial data that needs to be kept confidential, you need to ensure that your chosen accounting software offers strong security features that will prevent unauthorised access to your data.

Accounting software should be featured with frequent updates to ensure ongoing compliance with industry standards and adhere to governmental regulations, thus helping the organisation avoid penalties and legal issues while maintaining accuracy, transparency, and reliability of financial reporting.

It is necessary for users to find out further information about accounting software providers and their offerings and read reviews and testimonials of other users to ensure that the software’s available features and supporting services will satisfy their business needs.

In case your business intends to purchase an accounting software package from a value-added reseller, make sure to prioritise reputable software distributors who provide reliable and high-quality software solutions. Since these vendors will have a team of experts and professional consultants who can provide in-depth support and guidance throughout the implementation process, this ensures your business is investing in a trustworthy solution that meets your financial management demands effectively.

Presale services refer to the support and assistance offered by the software provider before a purchase is made. These services can include product demonstrations, consultations, and the provision of detailed information about the software's features and capabilities. Engaging with software providers who offer comprehensive pre-sale services allows businesses to get a clear understanding of the software’s operating mechanism and how it aligns with and satisfies their specific accounting needs.

Considering the level of support and guidance provided by the software provider will ensure a seamless transition and minimise disruptions that may arise during the implementation process. Additionally, choosing a software provider that has a proven track record of successful implementations and strong customer reviews can instil confidence in the chosen accounting software.

Support services provided by the software vendors are another crucial factor to consider when purchasing a software package. Your company may need further instruction, training, and ongoing support when you first begin to use a new accounting system.

Examining the total cost of ownership between software vendors helps businesses understand the long-term expenses associated with the software implementation process, beyond just the upfront costs. In this way, they can make informed decisions that align with their budgetary constraints and financial capabilities, avoiding any unexpected financial burdens.

In a study conducted on 3000 accountants worldwide by Sage People in 2018, 67 per cent of the participants stated that they "have their heads in the cloud"; and more than half of them have already adopted cloud-based solutions. It is time for your accounting function to be transformed digitally with cloud accounting software.

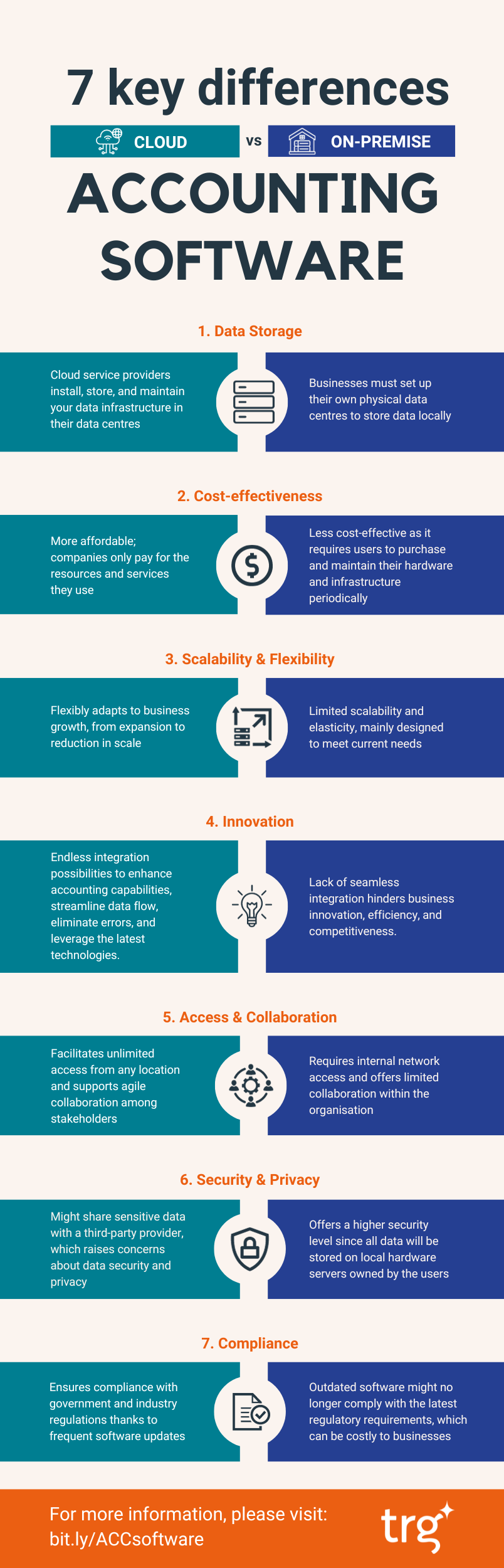

Traditional (on-premise) accounting systems require businesses to set up physical data centres. This, in turn, results in hefty upfront investment in hardware, IT personnel as well as time and effort to install and maintain the solution.

Cloud-based accounting solutions, on the other hand, store businesses' data in the cloud. Users can obtain financial information anytime, anywhere as long as they are connected to the Internet.

From a simple bookkeeping capability to sophisticated forecasting and budgeting functions, today's cloud accounting systems have drastically evolved to accommodate every business needs. Cloud accounting also offers a straightforward pay-as-you-go method and a highly secured environment to protect organisations online.

Check out our brief comparison between cloud and traditional/ on-premise accounting software via the infographic below.

Cloud accounting software eliminates the need for manual system installation. Users can tackle their day-to-day activities from any device, at any time.

Furthermore, the cloud-based system can be scaled up or down in an instant, has a fixed monthly subscription fee, and requires no upfront capital expenses making cloud accounting the most cost-effective solution for businesses regardless of size.

In addition to these advantages, cloud accounting software also possesses these five exceptional benefits:

Cloud accounting providers will take the responsibility of maintaining the periodic software backups and updates, freeing the organisations up for other mission-critical priorities. What's more, the maintenance and upgrades are carried out simultaneously across the organisation.

Therefore, instead of waiting for weeks or months for the latest iteration, cloud accounting software provides businesses with endless possibilities and unparalleled agility. The maintenance is already included in the monthly subscription fee.

Cloud accounting systems provide a quick snapshot into the business' most recent activities, thus, creating a more precise picture of how well the company is doing and empowering managers to make more informed decisions based on the latest financial situation.

Managers can easily monitor people's activities and access according to their responsibilities and level of authority. Once they have their access granted, users can only view information within their role, preventing them from viewing sensitive information when they should not.

Cloud accounting software is frequently backed up and continuously monitored, so the chance of a security breach occurring is very low.

Data stored in cloud accounting software is up "in the cloud" and can be retrieved anytime without any physical obstructions. Thus, organisations can function as normal despite the calamity.

Cloud accounting software ensures leaders regularly collaborate with accounting professionals to avoid any mishaps as well as ensuring the process of tax filing happens smoothly.

Purchasing a new management software can be confusing. To ensure the success of your cloud accounting software implementation, there are do's and don'ts you need to consider before committing to buying.

Establishing clear and measurable goals before embarking on this migration journey allows businesses to thoroughly conduct a comprehensive demand analysis, thus making informed decisions regarding the best cloud solution that satisfies their needs and aligns with the overall strategic objectives.

To successfully evaluate your existing infrastructure, it is essential to understand the technical and business requirements of your current system. This knowledge will guide you in determining which systems are suitable for cloud migration, which need updates or replacements, and which can remain on-premises.

When it comes to understanding the strengths, weaknesses, and pain points of your existing solution, there is no better resource than your accounting team. They work with the system day in and day out, making them experts in its functionality. Reach out to them to gain valuable insights.

In your current system, there are modules that your accounting staff relies on daily and expects similar or improved functionality in the new solution. On the other hand, there may be features or processes that are rarely used and cause friction. In these cases, automation can be a game-changer.

By identifying the specific steps that hinder your productivity, you will be one step closer to finding the perfect cloud accounting solution for your organisation.

The needs analysis allows you to dig deeper into the present pain points and discover new details like the latest industry-specific needs and policies. To successfully conduct an accounting system needs analysis, you can start with a few questions below to determine must-have features, modules, or add-ons in the new accounting solution.

Cloud accounting software offers a more predictable pricing model which enables businesses to control their budgets better. The pricing plans that organisations will typically encounter when purchasing cloud accounting software are annual/ monthly subscriptions (users are charged a flat rate periodically) and freemium (users are charged for using features outside of the original agreed package).

The prospective vendors should also be able to talk you through a typical implementation process and provide you with their proven success to back up their claims of delivering what they promise you.

The current software options on the market can be overwhelming with their enticing features and cutting-edge technologies. However, what truly matters is how well they meet your specific requirements. Thankfully, there are numerous software comparison tools and online review sites available to help you objectively evaluate each solution and vendor. You can read real reviews from organisations that have experienced the same solutions, or simply ask questions to gain valuable insights.

Most vendors will offer a demo version for clients, either online or on-site, to test out the solution before committing to purchasing. This is a critical step in determining if the solution is the right one for your organisation.

How well the vendors’ sales teams understand your organisation plays a vital role in determining the success of the implementation project. Have your list of concerns and requirements on hand and be ready to ask questions when possible. The cost of software delivery can vary based on the result of the demo.

Before the migration is conducted, a detailed plan for transferring digital assets is necessary to ensure a seamless transition process. You need to analyse the expenses associated with purchasing, operating, and maintaining local servers and how much they will contribute to your overall business expenses.

Not all businesses have adequate expertise and technical skills to conduct the migration by themselves. Collaborating with professional and reliable cloud providers can make all the difference in ensuring a successful transition to the cloud.

It is critical to establish a project execution team with professional expertise and experience in cloud technology. This team will connect both business and technical stakeholders to develop requirements and goals, recruit, train, and develop team members, and ensure the migration is carried out smoothly.

If your data becomes inaccessible to users during the migration, your entire business operations could be affected. Therefore, to minimise these risks, transferred data units should be validated individually to ensure it function correctly and can be retrieved on the new platform.

Post-implementation, you and your staff will encounter various issues from simple to complex that might require support from the vendor. A service provider that cares about their client’s success will help their clients to make the most out of the new software.

Once data has been successfully transferred to the cloud, it is vital to frequently gather and monitor user feedback and performance data. This enables businesses to promptly make necessary adjustments and optimise cloud operations.

Looking to enhance the success of your software implementation project? Dive deeper into effective strategies by exploring our informative blogs below:

Advanced financial management software has revolutionised how businesses handle their financial operations, offering enhanced automation, real-time insights, and improved decision-making capabilities. These solutions provide tailored features and functionalities to meet diverse organisational needs. By carefully examining available options, businesses can optimise their financial processes for improved efficiency and effectiveness.

With the latest version, Infor SunSystems Cloud is the financial management solution of choice for many businesses, regardless of size or industry. Powered by Infor OS, SunSystems Cloud can help your business with limitless integration possibilities that best serve your needs.

This scalable cloud platform was developed to meet the requirements of medium- to large-sized enterprises. With an expanded list of features that cover many aspects, NetSuite ERP provides accountants and bookkeepers with fundamental accounting features, such as the general ledger, accounts receivable and payable, tax management, and expense and revenue management facilities.

QuickBooks Online is popular among small and medium businesses, startups, and freelance accountants as it simplifies accounting tasks like tax calculation, expense tracking, invoicing, and sales management. Besides, the solution can handle sophisticated reports and manage bill payment processes, providing a powerful bank management feature that helps users keep a close eye on their bank account and recognise anomalies quickly.

Sage Business Cloud Accounting helps small businesses streamline their workflows by automatically sending and tracking invoices while also offering free training and 24/7 online chat support. Intergrated with Stripe for quick payments, Sage can also support businesses in keeping their cash flow healthy by connecting their bank accounts with a cloud system.

With a powerful and intuitively designed dashboard, Xero provides small and medium enterprises with the necessary tools to run their businesses: track and pay bills, monitor spending with an expense tracker, and even establish bank feeds. Users can also track their projects, manage their contacts, and examine accounting processes on one platform. For accountants and bookkeepers, Xero offers tailored solutions to meet specific needs, such as the Xero HQ for staff and client management, Xero Cashbook, and Xero Ledger.

Discover additional top-notch financial management providers, delve into the range of services they provide, and uncover their unique strengths by reading this informative article.

As an owner of a startup, effective accounting practices let you make strategic decisions and better understand where resources go. By implementing sound accounting practices, you can gain valuable insights into your business's financial health and identify areas for improvement. With a clear understanding of your revenue streams and expenses, you can make informed decisions to optimise your operations and drive profitability. Furthermore, effective accounting practices provide a solid foundation for financial planning and forecasting, allowing you to anticipate future challenges and opportunities and make proactive decisions to steer your startup towards success.

With a plethora of promising options available in the accounting software market, it is easy to feel overwhelmed when evaluating each solution to find the perfect fit for your startup. So, what are the essential functionalities that accounting software should have for startups?

In addition to these functions, other important features you can consider when shopping for a solution include:

Hotel accounting needs to corral different revenue streams but manually compiling data is no longer a viable approach. Today’s accounting departments need automation to eliminate disparate, siloed information.

Hotel's accounting software needs to be powerful enough to handle the influx of data hotels generate on a daily basis, and then extract insights from these data to make strategic business decisions.

The reporting tool is essential in showcasing daily rates, occupancy levels, and seasonal trends. Many accounting solutions come with pre-built, industry-standard report templates that offer greater flexibility for accountants to quickly dive into details that matter to all key stakeholders.

Dashboards are where critical performance metrics and financial information are visualised and displayed based on each viewer's role and responsibilities. The visualisations on dashboards allow managers to acquire fast answers at just a glance.

Automated data integration and consolidation

Hotel chains that manage multiple business units are required to see the bigger picture via one standardised, integrated report. A tool that enables hoteliers to do just that will help them to utilise their limited time to focus more on mission-critical tasks instead of combining and re-formatting different reports.

Furthermore, accounting software that is capable of communicating flawlessly with third-party systems, such as the reservations management system, POS machine, housekeeping function, or asset management system not only can help hoteliers eliminate silos, it can also empower them to make better decisions based on accurate data.

This feature allows managers to compare data through different variables (time, department, cost centre) and different scenarios, thus, enabling them to plan for the future in detail.

Even in cases that require detailed planning for the smallest cost item, an accounting function that allows users to divide a fixed amount of their main account line into sub-accounts and distribute over a defined period would be hugely beneficial.

Accounting software that allows simultaneous connection across the organisation can ensure that only relevant personnel will be involved in the process, and guarantee reports are done on time and complied with industry standards.

Some property management systems also integrate smart features that offer tighter control over housekeeping functions, facilities and asset maintenance as well as event bookings. Linking the accounting software and the central PMS is highly useful in ensuring hoteliers and revenue managers gain visibility of the entire business.

Integrating labour scheduling into accounting software allows managers to control costs and employee expenses better by ensuring minimum staffing, containing overtime hours, and scheduling the best-performing staff during the busiest times/ seasons.

The forecasting and budgeting functions in some accounting software allow managers to predict future needs, special events, or menu changes based on variances in expected versus actual ingredients used, spoils, mistaken orders, and other inefficiencies.

A dedicated function to handle relationships with both current and future customers will empower hoteliers to offer more tailored services. The customer's information stored in the CRM feature and their spending recorded in the accounting software is also useful for future marketing campaigns.

The financial services industry in the post-crisis era is still rife with challenges, both old and new, including extensive regulatory changes, technology disruptions, and a greater demand for trust and transparency. Financial services firms operating in such a contested environment need an accounting software solution that can deliver top-notch industry-specific capabilities.

As the financial services market is one of the most globalised industries in the world, the right accounting software needs robust multiple-language, multi-entity, and multi-currency capabilities.

Besides, how easily the finance professional teams can collaborate across multiple locations is also a critical aspect to consider.

Financial managers should be able to obtain quality insights in a timely manner with the help of advanced deep analytics capabilities to make informed decisions. Therefore, financial services organisations should look for accounting software that can accelerate the consolidation process while still maintaining the data's integrity and credibility.

Dashboards are an essential part of any financial services firm. Financial professionals need to be able to grasp critical insights - statistics, KPIs, charts, graphs, reports, etc. - at a glance, in real-time, and on the go.

Financial institutions should look for accounting software that allows them to create multiple dashboards to accommodate their needs in addition to allowing them to set permissions.

Integration capabilities are crucial for reporting and analytics. As financial data is stored in different formats and different systems across the organisation, the accounting software needs to have strong integration capabilities in order to pull data from multiple sources to prepare, analyse, and transform data into actionable insights.

Suitable accounting software will streamline various processes including month-end close, consolidation, management, and financial reporting, thereby, helping the firms to improve not only productivity but also help them to reduce costs.

The accounting software should also allow financial firms to generate and customise ad hoc reports with specific capabilities.

As the financial services industry is heavily regulated, accounting software must stay compliant with the latest standards and regulations.

Cloud-based accounting software, such as Infor SunSystems, complies with multi-GAAP, IAS, and IFRS which ensures organisations stay on top of any legislation change, always comply with the industry standards and local and international accounting regulations.

Nonprofit organisations do not put any product or service on sale but instead accept contributions in various forms (grants, donations, gifts, etc.) to fund their activities. As a result, having an accounting system in place that allows the organisation and their contributors to obtain complete visibility of the entire business performance is of utmost important.

Utilising Excel spreadsheets may be sufficient when the nonprofit first started. However, as the business grows and more contributions keep pouring in, the financial aspect will also become more complex.

In order to gain knowledge of how well the money is spent, both the organisation and stakeholders need to be equipped with highly reliable data. Suitable accounting software will be able to do just that; breakdowns of every spending, and incoming contributions are recorded in great detail, which ultimately prevents transaction duplications and strengthens public trust.

Manually inputting data using spreadsheets can be extremely time-consuming and a waste of effort. Accounting solutions are created to minimise clutter and provide one single source of the truth instead of carrying scattered documents that can negatively impact the business' bottom line.

In some occasions, nonprofits obtain funds from overseas which is in different currencies. Suitable accounting software that enables Account Payable/ Account Receivable Automation can significantly simplify the finance process and maximise the team's control over the organisation's spending.

The beauty of implementing accounting software is the ease of compiling and tracing back every transaction in case of an audit or a public inquiry regarding the organisation's funds. Thus, ensuring the business is always following the local compliance.

Insightful data is beneficial in many ways. By accurately documenting inventories, revenue streams, and expenditures, nonprofits will have a more robust understanding of their current situation before shaping the business strategy.

As other sectors, such as retail and manufacturing, have fully digitalised many key areas of their operations, oil and gas companies are also betting on improving their financial and operational performance. And their financial management systems lie at the core of this effort.

For oil and gas companies, cloud computing offers a much more flexible and manageable subscription-based cost structure. There is no hefty upfront software licence fee. Plus, investment in hardware and other infrastructure is kept at a minimal level. Therefore, CAPEX is sharply reduced.

Instead of spending time and money on software customisation, oil companies should opt for solutions that can quickly be adapted to their specific requirements.

With Infor SunSystems, for instance, you can easily configure the system for different types of oil and gas businesses, such as joint venture accounting.

Businesses in the oil and gas sector often require strong support for international growth. SunSystems can support a transaction with at least four currencies. The number of currencies that can be stored within the system is unlimited, providing automated currency conversion when entering a transaction.

Gaining real-time insights into key financial and operational information is critical. Built-in multidimensional analytics allows you to easily keep track of key performance indicators such as lifting cost per barrel of oil equivalent (BOE), working capital interest and profit per BOE. You can customise these indicators to better match your business changes.

The oil and gas industry has highly complex reporting requirements – local statutory reporting, management reporting, joint venture/joint interest billing (JV/JIB) reporting, AFE reporting and tax reporting. They can be simplified significantly when you have multiple views of your data from a single source of truth, i.e. a unified ledger.

Infor SunSystems for Oil & Gas is widely deployed among upstream oil companies because of its many industry-specific features such as:

Infor SunSystems, among the first Infor products hosted in the cloud, is about to have some more major upgrades: smoother integration with other systems, better security, and functional enhancements.

The most noticeable change is that SunSystems is now part of Infor OS – the next-generation enterprise technology platform. This means the solution will be able to better integrate with a host of other Infor products such as Infor Birst, Infor HCM, Infor HMS (Hospitality Management) and Infor CRM.

In another sign of SunSystems’ increasing importance to Infor, the development of the reporting tool Infor Q&A will again be assigned to the SunSystems development team.

Security will also be significantly bolstered in future SunSystems releases. Infor OS provides a common security model for an increasing number of its solutions including:

Infor even employs an ethical hacking team whose sole job is trying to break into the Infor systems.

The system allows you to accomplish financial management tasks seamlessly, transcending borders and languages, that would’ve otherwise slowed down the functioning of your growing business.

The SunSystems can be easily modified to fit your business goals, with a proven step-by-step implementation process and a post-implementation review, to ensure your success. You save time and money since from just a few clicks you can automatically capture and archive any type of business documents, such as invoices.

With Infor SunSystems, you can streamline consolidation, reporting, and analysis of data from third-party organisations, gaining insight into every aspect of your business that matters to you. As a result, you will be able to simplify your budgeting and spending to implement your decisions vigorously.

Scale, Innovate, and Transform Your Accounting Team with Infor SunSystems Cloud

Infor SunSystems Cloud is a flexible and scalable SaaS financial management and accounting software solution that automates key finance and accounting processes. It enables businesses to work faster and more efficiently, streamlining financial operations and freeing up time for strategic activities. As an Infor Gold Channel Partner, TRG International offers comprehensive implementation services to help companies upgrade their financial systems.

Explore this comprehensive 7-in-1 data sheet on Infor SunSystems Cloud, providing you with a deep understanding of the essential modules that form this dynamic financial management solution. Discover everything you need to know about this powerful software and unlock the potential for transformative growth in your business.

Looking to delve deeper into the world of accounting and financial management software? Drop us a note and request a demo using the form on the right-hand side. We're eager to have an intimate conversation with you and explore the possibilities together!

Security is a major concern in our industry. Using Infor solutions was instrumental in ensuring we were delivering features with a high level of security and data privacy.

Howard Phung Fraser Hospitality Australia

TRG provides us with high-level support and industry knowledge and experience. There are challenges and roadblocks but it's certainly a collaboration and partnership that will see us be successful at the end.

Archie Natividad Aman Resorts

IT, Talent and F&B - we think it's a great combination.

We've thrived since 1994 resulting in lots of experience to share, we are beyond a companion, to more than 1,000 clients in 80+ countries.

© 2023 TRG International. Privacy Policy / Тerms & Conditions / Site map / Contact Us

TRG encourages websites and blogs to link to its web pages. Articles may be republished without alteration with the attribution statement "This article was first published by TRG International (www.trginternational.com)" and a clickable link back to the website.

We are changing support for TLS 1.0 and older browsers. Please check our list of supported browsers.