The financial services industry in the post-crisis era is still rife with challenges, both old and new, including extensive regulatory changes, technology disruptions, and a greater demand for trust and transparency. Financial services firms operating in such a contested environment need an accounting software solution that can deliver top-notch industry-specific capabilities.

So how does accounting software cater for the financial services industry look? What should be included in the 'must-have' features and capabilities list?

Read more: What does the future hold for financial forecasting?

Six must-have features of accounting software for financial services

1. Global capabilities

As the financial services market is one of the most globalised industries in the world, the right accounting software needs robust multiple-language, multi-entity, and multi-currency capabilities.

The software needs to be able to capture information from different business locations, records, and transactions in multiple currencies, all from one login. Class-leading software like Infor SunSystems allows for up to 5 reporting currencies per transaction.

Besides, how easily the finance professional teams can collaborate with each other and with other departments across multiple locations is also a critical aspect to consider. In the financial sector, you cannot afford to let internal communications get lost in translation.

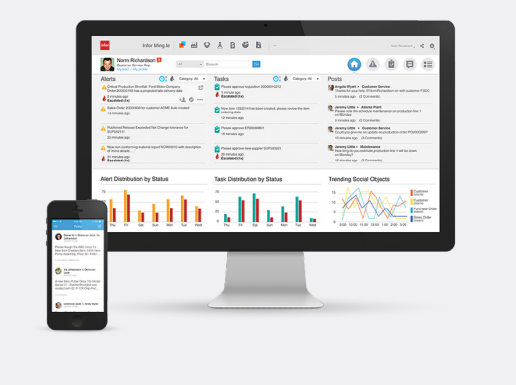

Social collaboration tools such as SunSystems' Ming.le use mechanisms similar to those of social networks, like chatting, tagging, and commenting, allowing employees to work more effectively as it combines social communication and business processes.

2. Fast consolidations

The traditional financial close process typically takes weeks to complete, which, in today's time, is deemed insufficient. A split of a second can make or break a deal.

Financial managers should be able to obtain quality insights in a timely manner with the help of advanced deep analytics capabilities to make informed decisions that can potentially make the most impact on their organisations.

Therefore, financial services organisations should look for accounting software that can accelerate the consolidation process while still maintaining the data's integrity and credibility. At the same time, the software should help businesses to maximise their performance and enable them to efficiently manage multiple entities, multiple currencies, asset types, and meet the changing compliance requirements with ease.

3. Dashboards for multiple devices

Dashboards are an essential part of any financial services firm. Financial professionals need to be able to grasp critical insights - statistics, KPIs, charts, graphs, reports, etc. - at a glance, in real-time, and on the go.

The ability to acquire real-time, relevant information at the fingertips allows the finance teams to address issues, quickly respond to changes and immediately act on new opportunities.

Financial institutions should look for accounting software that allows them to create multiple dashboards to accommodate their needs in addition to allowing them to set permissions.

Furthermore, the software should allow you to limit the dashboards access and the capability to drill down transactions to specific levels, such as based on the employee levels, departments, or open to everyone across the organisation to view.

For example, branch managers, finance team members, and external CPAs all have different data needs; their responsibilities undoubtedly also vary, which results in each of their dashboards must be tailored specifically to their roles.

4. Integration capabilities

For a financial services firm, seamless integrations among back-office and front-end systems (asset management, banking, insurance, trading) are critical to the speed and accuracy of transactions. When data can easily flow in and out of your accounting system, your firm is poised to deliver better returns to clients in any volatile market.

Additionally, integration capabilities are crucial for reporting and analytics. As financial data is stored in different formats and different systems across the organisation, the accounting software needs to have strong integration capabilities in order to pull data from multiple sources to prepare, analyse, and transform data into actionable insights.

Why waste time going through the hassle of converting documents into an Excel file and combining everything manually when there is software that can automatically do the task for you?

Read more: 5 compelling reasons why you need a cloud accounting system today

5. Multi-dimensional and real-time reporting

Traditionally, data used for reporting is pulled from different sources and compiled in a spreadsheet. This manual approach has a downside in which it would break the underlying connection of the data, causing invalid analysis if any modification is made.

To ensure the credibility of data, firms need to conduct additional manual reconciliation control. But this step is often bypassed, which raises doubts about the reliability of the information.

Also, as a typical reporting process necessitates buy-ins from multiple departments, the information often becomes outdated and irrelevant before managers and shareholders are even able to review the financial statements.

Furthermore, financial professionals must repeatedly update reports for each passing period, which consumes lots of financial professionals' resources and causes inconsistency.

Read more: It’s time to replace your spreadsheets with planning and budgeting software

Suitable accounting software will streamline the financial services organisations' processes including month-end close, consolidation, management, and financial reporting, thereby, helping the firms to improve not only productivity but also help them to reduce costs.

The accounting software should also allow financial firms to generate and customise ad hoc reports with specific capabilities.

6. Regulatory compliance

As the financial services industry is heavily regulated, the accounting software must stay compliant with the latest standards and regulations.

Infor SunSystems complies with multi-GAAP, IAS, and IFRS which ensures organisations stay on top of any legislation change, always act in accordance with the industry standards and local and international accounting regulations.

Infor SunSystems offers all of the features mentioned above plus the ability to deploy in the cloud, on-premise, or both.

Its most recent update, SunSystems 6.4, is designed with unrivalled capabilities that aim at accelerating business growth.

Its intuitive user interface, built-in advanced analytics, and artificial intelligent digital assistant empower users to achieve more, take full advantage of data, and speed up market decisions with compelling analysis and reports.

To witness first-hand the full power of Infor SunSystems and to learn how this modern financial management solution can benefit your organisation, talk to our team of experts by clicking the button below.

English

English  Vietnamese

Vietnamese