As planning, budgeting and forecasting become indispensable strategic contributors, finance executives begin to realise the need to transform their rigid yearly financial planning by adopting more advanced (both on-premise and cloud-based) analytical tools. 71 per cent of organisations surveyed by FSN in 2017 has been able to reforecast more than twice a year, up from 56 per cent in the previous year, although the forecasting accuracy is still fairly low.

The sad news is, 70 per cent of businesses in the same FSN's survey still rely heavily on spreadsheets as the primary method for forecasting. Only 16% have dedicated on-premise software to handle the planning, budgeting and forecasting. The number of organisations that use cloud-based solutions is merely 10%.

Read more: Automating financial forecast for hotels with cloud systems

Spreadsheets are no longer a viable approach in today’s volatile and complex market. Is digital transformation the only answer?

What does the future hold for financial forecasting?

For ages, people have been leveraging machines to take away the repetitive, manual tasks. Before long, computers have proven their usefulness and started to penetrate deeper and deeper into businesses' operation, becoming a necessity to survive.

However, it is getting more challenging to manage both daily operations and the overflowing amount of data. Relying on spreadsheets and other basic analytic tools is not enough and can drag the business down.

This is where emerging technologies like cloud computing and Artificial Intelligence (AI) come in to lessen the complexity, automatically find hidden insights without being asked to, thereby improving the prediction accuracy when needed.

Read more: Will smart technologies replace CFOs?

Leverage emerging technologies to standardise and automate the forecasting process

Cloud computing

Standardisation and automation used to be the "nearly forgotten" priorities of CFOs, but today, the table has turned.

Research has shown a strong agreement among senior finance executive for realising the immense benefits of cloud computing. The technology has also reached its maturity stage, backed by a widespread adoption rate.

Trendsetters and followers have prepared their functions to take on standardisation and automation by linking front and back-office to streamline the flow of data, reinforce insights used in forecasting, promote better integration, thus, allowing them to focus on strategic imperatives.

Artificial Intelligence

Despite having endless practical applications, AI and machine learning technologies are still in their infancy.

A fair amount of senior finance executives believe that people will be more dependent on machine learning to achieve maximum forecast accuracy. On the flip side, an equal amount of finance professionals believe having a human touch makes the process more complete as global uncertainty (or any new driver that does not have preceding information) can constraint the machine prediction.

The human expertise (assuming the human involved have a background in analytics) can help incorporate these unprecedented events into the forecasting models while machines help to eliminate the human’s bias.

A robust forecast algorithm calls for the right data, context, process, and skills on hand. AI and machine learning may potentially be the future of every organisation, but unless they are tightly integrated into the organisation's broader ecosystems, touching both financial and non-financial data, the applications of these breakthrough technologies will remain narrow.

How is your analytic tool doing?

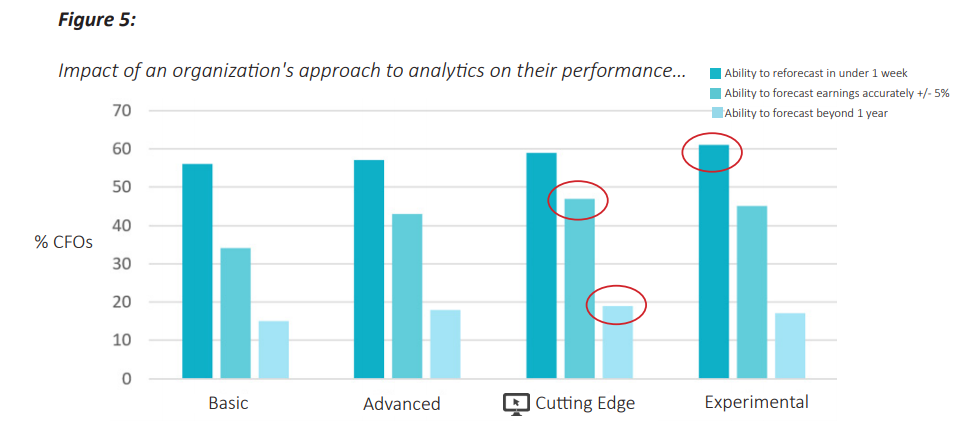

According to the FSN survey, tools used for planning, budgeting and forecasting are categorised into four common groups: basic (spreadsheets), advanced (pivot tables and business intelligence), cutting edge (advanced visualisation, charting and graphs), and experimental (machine learning and AI).

A notable trend to pick up from the survey is a significant part of senior finance executives have embraced some forms of advanced forecasting tools. This group is expected to move on to adopt cutting edge technologies and leap further.

When comparing side by side, cutting edge and experimental forecasting tools clearly take the lead in terms of performance and accuracy. The cutting edge group performs slightly better than the experimental one in two areas: "ability to forecast earnings accurately +/- 5%" and "ability to forecast beyond one year" (graph below).

Source: The Future of Planning, Budgeting and Forecasting - Global Survey 2017 (FSN)

The answer to this turn of events is quite simple. While new, advanced technologies are an essential part of the journey to digital transformation, they are not always the cure for the itch. As previously mentioned, machine learning and Artificial Intelligence are still in their infancy stage; it will be a long while until they reach their plateau.

Companies that have successfully deployed cutting edge forecasting tools are tech-savvy organisations that value the cloud and leverage forecasting specific tools for the purpose of extracting insights. Cutting edge companies also plan to deploy more advanced analytic tools and move the entire planning, budgeting and forecasting processes to the cloud in the next three years.

This can put these companies in a far better position. Their forecast accuracy will also be far more superior compares to the less adventurous ones.

Read more: 3 ways AI is providing personalised experience to hotel guests

Non-financial data plays a vital role

Cutting edge technologies can positively impact forecast outcomes, but technology alone can’t make a difference in the long term. Advanced analytics need relevant data that goes beyond the finance function's border. CFOs have to connect with stakeholders outside the finance realm to improve the accuracy of their forecasts.

Read more: Don’t skip non-financial data in corporate reports

Buy-ins from all stakeholders and the forecast outcomes need to be trusted and respected in order to achieve strategic goals.

Having the right solution in place is only one part of the formula; organisations need to master the art of extracting non-financial data to become “insightful." And insightful companies have in their hands the ultimate power to reforecast in under one week, forecast earnings accurately within +/- 5% as well as forecast beyond the one year’s time.

The cloud can certainly help businesses with standardisation and automation; it can also boost interdepartmental collaboration among teams, allowing companies to obtain insights when needed. To learn more about the practical applications of the cloud CFOs should be aware of, download our whitepaper today!

English

English  Vietnamese

Vietnamese