Recent research by Anaplan, an expert on modelling and planning finance, sales and operations platforms, states that currently, Asia Pacific’s CFOs are still experiencing difficulties with spreadsheet usages in financial planning and budgeting. In addition, there was a relatively low satisfaction level with the accuracy, timeliness and ease of Excel use for planning and budgeting.

Read more: A complete guide to financial consolidation

Microsoft Excel as a tool for financial planning and budgeting

According to the research, 43% of respondents use Microsoft Excel for financial planning and budgeting and another 19% also use it in 70% of their planning. However, roughly one-third of those Excel users in 70% of financial planning and budgeting are unsatisfied with the accuracy of the results. This mainly resulted from Excel being not flexible enough to provide a more dynamic view, meaning Excel is not only inaccurate but also limited in describing the whole picture of financial planning and budgeting.

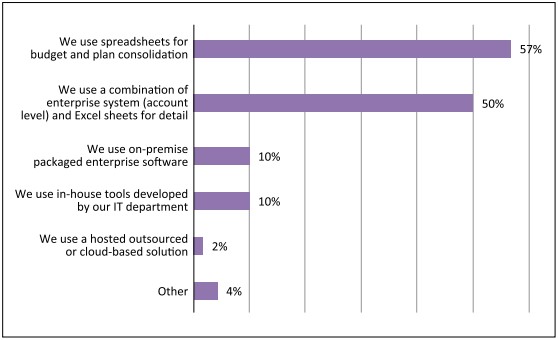

The table below (Anaplan 2013) uncovers tools that companies use for the planning and budgeting:

It can be clearly seen from the above table that despite its limits, Excel is still dominant in the current practices of CFOs in Asia. Only around 20% of the respondents equally chose either on-premise packaged enterprise software or an in-house developed system and a mere 2% outsourced or used cloud-based solution.

As for the satisfaction level with Excel accuracy in planning and budgeting, the results say companies who use Excel in less than 30% of their planning and budgeting process are somehow satisfied compared with those that use more than 70%.

In explanation, 59% of respondents said the most common cause is because of Excel inability in analysing “what if” scenarios and detailed integration and operational planning. Another 53% complained about the difference between adjusted results and forecasts.

Additionally, Excel users find financial planning and budgeting to be a huge time consuming process. It wastes a lot of time to gather data from related departments and process it before they can get useful information. Some other issues including the inflexibility of Excel, unfriendly interface, or lack of skilful staff, together accounted for the dissatisfaction of most CFOs.

Read more: Automating financial forecasting for hotels with cloud-based systems

Alternatives to Microsoft Excel

Responding to the question “What would make you more satisfied with your financial planning and budgeting?” many planners expressed that they prefer having better results by adopting a process based-system rather than a spreadsheet-based one.

They require a platform with ‘what if’ scenario analysis capability, which can increase budgeting accuracy and ability to gather data from all business areas. Last but not least, 69% of respondents want a system process that can capture and upload operational data faster, and 53% prefer faster and smarter data analysis.

So what and how exactly will these respondents do if they had a chance to redesign and implement financial planning and budgeting again. Although there are various solutions, most of them wished for something like an integrated system including accounting, ERP, BI , Analytics or financial planning software. This system should be able to quickly upload, extract, analyse data, and improve the accuracy and processing speed, while its interface must be user-friendly and flexible.

In the past decades, Excel was truly the No.1 option for financial budgeting and analysis. But today it has changed as this option has not evolved and upgraded itself as fast as the demands that CFOs have risen. So, is now the right time for you to move on from Excel and discover and experience the benefits of other technologies?

Download our latest whitepaper to learn more about the potential of cloud-based applications CFOs should be aware of!

English

English  Vietnamese

Vietnamese