Customer relationship management has become a central focus to all organisations. Nowadays, companies have gradually recognised the significant costs caused by losing a customer and have worked hard to better understand, measure, manage, and improve customer retention. A study suggests that “for each existing customer that left, the company needed to bring in 1.2 new customers at an approximately 20 percent lower price to replace the lost revenue, and two to three new customers to replace the lost margin“ (Karl Stark and Bill Stewart in “The Hidden Costs of Customer Attrition”). To help companies address customer value creation issues, this article provides a systematic approach to set up a customer value management cycle.

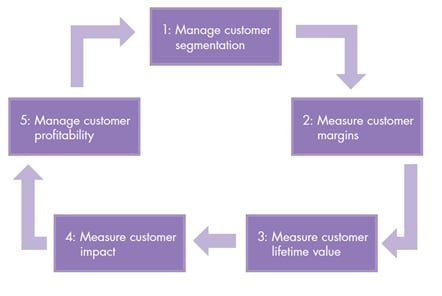

There are 5 steps to customer value management:

Step 1: Manage customer segmentation

Segmentation allows the company to target specific groups of customers as to provide differential advertising or value proposition for the best customer service effect. There are 4 ways to customer segmentation:

- Demographic segmentation: segment customers based on demographics e.g. age, geographic area or income level. However, for many products or services, these do not fully represent the customers buying behaviour and have not been useful

- Psychographic segmentation: segment customers based on psychographic and lifestyle characteristics such as attitudes and interests, value, and social roles. This approach assumes that customers’ buying behaviour are affected by their habits and routines

- Behavioural segmentation: segment customers based on buying behaviour such as knowledge, usage rate, benefit sought, and loyalty status. This is the most effective approach to date

- Analytic segmentation: a method that integrates criteria such as cost into the value calculation of the customer segments. This, along with the above methods, allows companies to more effectively target their most profitable customers

Step 2: Measure customer margin

Activity-based costing (ABC) has been widely used for product costing by assigning non-product costs to product costing calculations. ABC recognises that product costing is not only direct costs but also indirect costs. It provides a method to incorporate indirect costs to specific segments, which results in better estimation of product costs.

There are many ways to identify non-product cost categories, one of them are:

- Order-level costs

- Customer-level costs

- Channel-level costs

- Market-level costs

- Enterprise-level costs

For detailed discussion and application of the 2 steps, read the full CGMA Tools whitepaper “How to manage customer value (part 1)”

***

*This is the first articles of three articles in the series “Customer value creation”, check back on this blog to read two upcoming articles of the same series

- 8 Feb 2013: Value creation: 5 steps to customer value management (part 2)

- 22 Feb 2013: How to create and derive more value from customers – A comprehensive example

English

English  Vietnamese

Vietnamese