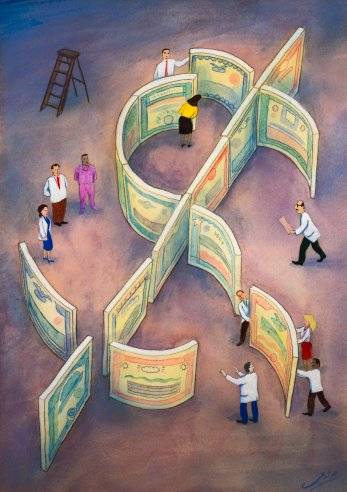

A Framework for Investment Decisions. Realizing an appropriate return on capital spending is critical. Poor allocation of strategic funds can impair the competitiveness and profitability of a corporation, which is why well-run organizations have a disciplined methodology for making these decisions.

Using the right framework and measuring the potential return is the first step in ensuring that a company considers all relevant factors and weights them appropriately in evaluating investment opportunities.

Companies use an array of different approaches to assess potential capital investments, but in all cases it’s important to accurately define the costs and benefits and estimate the value attached to each. For many projects, the numbers are cut-and-dried and measuring the payback is straightforward. However, when it comes to buying software to address planning and budgeting (as well as performance management capabilities such as scorecards, dashboards and performance analytics), the sources of return on investment are not always obvious. That’s because software investments can have complex impacts on both efficiency and effectiveness.

Key points of this whitepaper are:

- Assessing Return

- A Framework for Measuring Software ROI

- Use the Right Tool for the Job

English

English  Vietnamese

Vietnamese