The International Financial Reporting Standards are the result of work begun in the early 1970s by the International Accounting Standards Committee (IASC). The slow evolution of IFRS adoption was accelerated in 2002 when the European Union Parliament designated IFRS as the accounting standard for publicly traded European Union companies beginning on January 1, 2005.

Since 2005, numerous countries with highly developed economies, such as Australia and New Zealand, have adopted IFRS. Meanwhile, the adoption in Asia has been mixed. IFRS convergence has happened in China and Japan, effectively bringing their local financial reporting standards in line with the international standard. South Korea and Taiwan have not made the transition.

The US is by far the largest market yet to transition to IFRS, although the process has begun. Canada, another world-leading economy, and Mexico are also transitioning to IFRS.

Closer to Vietnam, countries in South East Asia have applied IFRS or have plans to convert to IFRS. For instance, Philippines has adopted IFRS with some local modifications, whilst full conversion to IFRS in Thailand is expected in 2013.

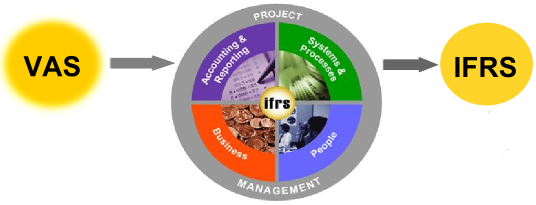

Although the exact timetable for IFRS conversion in Vietnam has not been set, The Ministry of Finance (MOF) is currently working on a number of Vietnamese Accounting Standards which are based on IFRS. Currently all the Vietnamese Accounting Standards are based on the old version of IAS. Commercial joint stock banks will likely be required to prepare their IFRS financial statements in addition to the financial statements prepared under local GAAP. Currently they are only encouraged to do so. (PwC, 2011).

At this point, with more than 100 countries already using IFRS and the world’s largest economy starting the process, the trend is clear. Over the next five to 10 years, adherence to IFRS will become a basic requirement for doing business.

IFRS is, in large part, an outgrowth of business globalisation. While there are pockets of resistance in business and government, there is a clear consensus that the benefits of IFRS will include facilitating global economic growth. For example, in a 2007 survey by the International Federation of Accountants (IFAC), 91% of the accounting leaders surveyed said that a single set of international financial standards was important or very important for economic growth in their countries.

***

In the next post, we will discuss what IFRS really mean to businesses. Can’t wait? Download the full white paper “FROM VAS TO IFRS: Building business efficiencies and greater competitiveness for Vietnamese companies”.

Subscribe to our blogs to get great content delivered straight to your inbox!

English

English  Vietnamese

Vietnamese