The recent global pandemic has caused traumatic financial impacts on all industry, and manufacturing is not an exemption. According to a recent survey conducted by the National Association of Manufacturers, 78.3% of manufacturers expect disruptions in both their financial and operational performance. This is a significantly higher percentage compared to the 48% of cross-industry companies concerning the same issue.

Low economic demand, tighten spending, supply chain bottlenecks, etc. all reasons point out that the traditional mass-production model does not fit today’s changing economic landscape. It is time for manufacturers to seriously consider “going lean.”

Lean manufacturing requires lean accounting

Lean manufacturing has been around for decades and has been widely adopted by various manufacturing businesses worldwide.

In contrast to the traditional mass-production model, where the main goal is to produce as much as possible, lean manufacturing focuses on eliminating waste, reducing inventory levels, maintaining the shortest possible lead times and production cycle to meet customer demand.

Businesses that have successfully implemented this lean model see a significant decrease in lead times up to 90% and a 50% reduction on inventory turnover, thus, freeing up 25% production capacity.

Having said that, while the lean manufacturing model produces positive outcomes, such outcomes are not correctly presented on the business' financial statements, which makes accountants, operation managers and business owners misunderstand the true value of lean manufacturing.

In other words, traditional cost accounting is unfit in a lean manufacturing environment. Thus, lean accounting was developed to counteract questions that standard cost accounting was unable to answer.

Cost accounting vs lean accounting

In short, standard cost accounting values overproduction, which goes against the fundamental goal of lean manufacturing. Furthermore, as the manufacturer produces fewer products, traditional financial statements will indicate an increase in the cost of completing each unit. Labour and overhead are categorised as "deferred costs" as they are not absorbed as quickly. The effect of this is inaccurately priced finished goods, which makes the business less competitive.

Lean accounting, on the other hand, reveals costs that are otherwise misinterpreted or hidden, such as labour and machinery, and uses objective metrics that support lean initiatives. Standard cost accounting categorised overhead as fixed costs. In lean accounting, they are variable costs and are assessed case-by-case.

Nevertheless, cost accounting is not entirely ineffective. It is just unsuited for a lean environment.

How does lean accounting work?

Value streams

Value streams are the most vital core element of lean accounting. A value stream is everything that goes into getting a product sold. It starts from a sales process and goes all the way to purchasing, production, and shipping.

A lean organisation views each department as value streams, or profit centres, and focuses on enhancing the productivity of these value streams.

The ultimate goal of lean manufacturing and lean accounting is to flow orders through these value streams as fast as possible but still maintain the highest quality of products.

As value streams are profit centres, all expenses and profits need to be assigned and analysed at this level.

Plain English financial reports

Variances of costs, material usage, or labour rates recorded in traditional financial statements are often difficult to understand for non-finance individuals.

In lean accounting, financial and operational reporting are done at the value stream level and is typically conducted weekly. As a result, financial statements in lean accounting are generated faster and in an easy to understand manner, or in plain English, showcasing vital operational measurements that every member of the business can grasp and use.

An additional notable advantage for having plain English financial reports is it displays actual revenue earned and the actual costs incurred for the period being reported.

Customer value

As previously mentioned, a manufacturing business that implements lean methodology will emphasise eliminating waste and focusing on achieving the shortest possible production cycle to meet customer demand.

By going lean, manufacturers will need to divide the organisation into various workgroups, or cells, and cross-train each worker so they will be able to perform all activities to produce the finished product. This approach is opposite to the traditional production process, where parts and materials move across the factory for assembly.

By dividing the organisations into working groups, which are also the value streams, employees will focus more actually design, engineer, sell, and market products that bring value to a customer.

Once manufacturers start to offer products that meet customer demand, their loyalty, business growth, and profits also increase as a result.

Decision-making

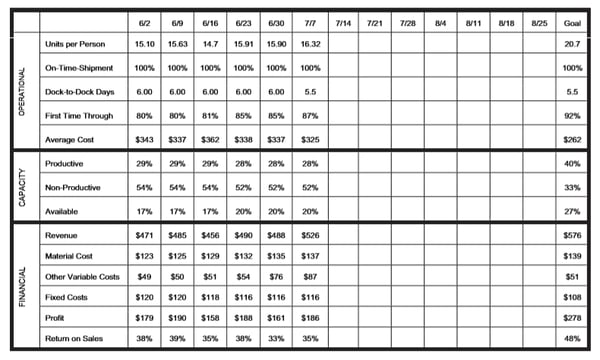

Decisions are drawn from the impact on the company's total value stream profits. A tool commonly used in lean accounting is "box score." Box score typically is a one-page summary of the operational and financial performance of a value stream as well as how it utilises capacity.

Box score is powerful in which it enables value streams to make decisions based on readily available information. The box score also presents the impact of the decisions on operations, employee's capacity, and the profit of the value stream.

This bottom-up approach allows employees to understand the impact of their actions and how they can contribute to the organisation.

Example of Box Score Weekly Performance Reporting. Credit: AICPA

Best practice in using lean accounting to reduce inventory

When lean accounting first implemented, manufacturers will be stuck with loads of inventory on hand, but the amount of stock will gradually decline.

The lean effect will not be visible immediately as it takes time to "digest" the current inventory on-hand until it reaches the desired level.

What happens at the early stage is the manufacturers will deploy the make-to-order method, where products will only be fabricated if there is an order to ship. However, instead of producing a new batch, manufacturers will utilise remaining finished goods, and items will not be restocked until they reach the optimal level of work-in-process and finished goods.

The profit, on the other hand, will be lower compared to the previous mass production period, which might raise concern and question in the organisation that the lean approach is not effective.

The accounting department needs to take an active role in communicating the impact of being lean on the company's bottom line and inventory levels.

Best practice in adopting lean accounting for accountants

Instead of completely removing the standard reporting from the system overnight, the accounting team can gradually introduce lean improvements to supplement the traditional financial statements.

In an article written by Nick Katko, President and Owner of BMA, Nick advises accountants to be more open-minded and adjust their perspective to adopt lean accounting. He also comments that lean accounting is a journey full of continuous improvements, which ends with refining the whole organisation.

Accounting can be impactful, drive the organisation's growth, and keep the customers satisfied. Being lean requires the accountants to be efficient in communicating with both external customers and internal customers through making appropriate adjustments to accounting processes.

The lean methodology when applied to the accounting functions also means that it is necessary to eliminate "waste" in accounting processes, such as implementing suitable solutions to accelerate reconciliations, shorten the forecasting and budgeting cycle, close books faster, etc.

Sudden change is difficult to accept. By slowly shifting the process piece by piece will encourage accounting staff to gradually pick up new habits and help them to understand the change is necessary.

English

English  Vietnamese

Vietnamese