Planning and budgeting provides valuable insights for managing risk, boosting corporate performance and shareholder value and making strategic decisions. Using a business model as the basis of the planning process enables the development of: charts of accounts; time divided by years/quarters/months; version control to store actuals/budgets/forecasts and other important data segments, which can be used to create the plans. Organisations should look for planning solutions capable of delivering flexible business models that are mapped to their unique business requirements.

Recent TRG blog posts

What to look for in a planning and budgeting solution

Posted by Oanh Nguyen on Sun, Jun 21, 2015

Blog Topics: Planning and Budgeting

Planning and Budgeting Software: Solutions to Common Problems

Posted by Rick Yvanovich on Thu, Jan 22, 2015

Jack Welch, former Chairman at GE once said: “The budgeting process…sucks the energy, time, fun, and big dream out of an organization”. Yes, everyone hates it! If there is an effective way to do it without trying too hard will you take its advantages to grow? What you need is just a good planning and budgeting process and the right technology!

Blog Topics: Planning and Budgeting, CFOs, Financial consolidation, planning and reporting, Financial Accounting Management Software

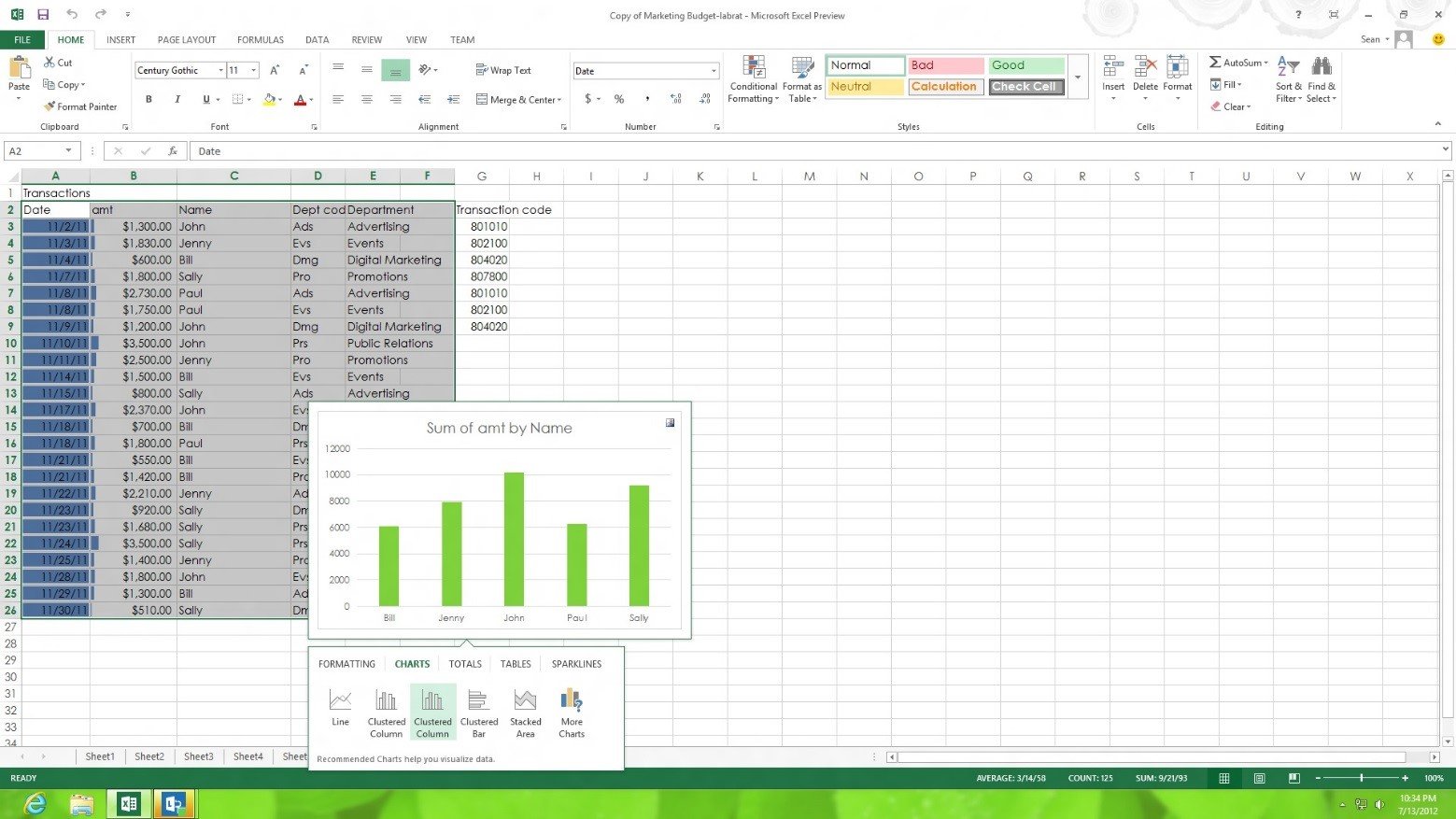

Getting rid of Excel in financial planning and budgeting: modern trend for CFOs

Posted by Rick Yvanovich on Mon, Jan 12, 2015

Recent research by Anaplan, an expert on modelling and planning finance, sales and operations platforms, states that currently, Asia Pacific’s CFOs are still experiencing difficulties with spreadsheet usages in financial planning and budgeting. In addition, there was a relatively low satisfaction level with the accuracy, timeliness and ease of Excel use for planning and budgeting.

Read more: A complete guide to financial consolidation

Blog Topics: Planning and Budgeting, CFOs, Financial consolidation, planning and reporting

Planning and budgeting for success

Posted by Rick Yvanovich on Tue, Nov 19, 2013

Blog Topics: Planning and Budgeting, CFOs, Financial Accounting Management Software

Agile EPM: how leading corporations can make it

Posted by Rick Yvanovich on Wed, Sep 11, 2013

Blog Topics: Planning and Budgeting, Enterprise Performance Management (EPM), Financial Accounting Management Software

Success factors of strategy and execution alignment

Posted by Rick Yvanovich on Fri, May 3, 2013

In the last post, we outlined the alarming issue of a strategy gap in businesses nowadays and how it can be undesirably widened by failures in strategic planning and budgeting. To gain a competitive advantage and increase business resilience, companies need to bridge this gap between strategy and execution, the task that requires serious dedication from everyone in an organisation. There are four factors of an effective strategy and execution alignment, from conveying what corporate goals really mean to identifying how they should be achieved.

Blog Topics: Planning and Budgeting, Enterprise Performance Management (EPM)

Strategy and execution: The gap not yet closed

Posted by Rick Yvanovich on Fri, Apr 26, 2013

It is hard enough to come up with an effective corporate strategy. It is even harder to execute that strategy effectively to achieve desirable outcomes. A 2009 study on employees found that 70% of them were confused about what they needed to do to support their company’s strategy. The same study, published in Fake Work by Brent D. Peterson & Gaylan Nielson, Simon Schuste, “half of all the work people did had nothing to do with their company’s strategy”. For the last dose of alarm, 73% of surveyed workers did not think their company’s goals are translated into specific executable work.

Blog Topics: Planning and Budgeting, Enterprise Performance Management (EPM)

CFOs and finance professionals: Time to change the way you work

Posted by Cuong Nguyen on Tue, Feb 19, 2013

“It’s an increasingly complex world” (Accenture, 2012)

Today, economic turmoil and volatility are dominant and the roles of CFOs and senior finance managers are changing. Thus, it’s critical that CFOs are able to:

Blog Topics: Planning and Budgeting, CFOs, Financial consolidation, planning and reporting, Financial Accounting Management Software

How technology can help you with IFRS adoption

Posted by Rick Yvanovich on Tue, Feb 12, 2013

In our view, companies are best served when they take an integrated approach to build an IFRS framework. Toward that end, they need a fully integrated solution ideal for supporting the IFRS adoption. A key element is the ability of enterprise applications to work in conjunction with financial management ones to meet a wide range of accounting requirements and processes mandated by the International Financial Reporting Standards.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

The process for building IFRS framework

Posted by Rick Yvanovich on Tue, Jan 29, 2013

Adopting IFRS alongside VAS requires technical, strategic, and operational changes. There also will be an unavoidable impact on information technology (IT) systems, as companies change the way they manage and report on numerous business activities. Hence, companies should employ a methodical approach when building the IFRS framework.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

English

English  Vietnamese

Vietnamese