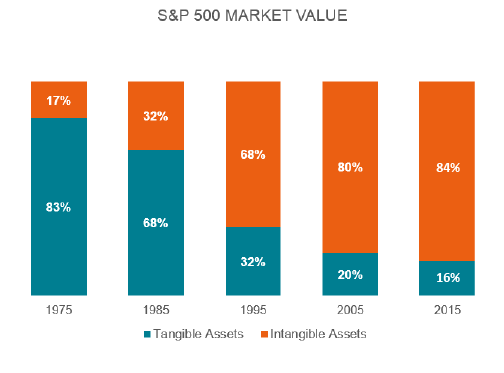

In addition to being difficult to manage, intangible assets have traditionally been a challenge in terms of communicating their value. Financial reporting has not evolved fast enough to adequately capture the true value of the organisation’s intangible assets and to address the needs of business decision makers.

The challenge of reporting intangible assets

Despite rapid growth in the value of intangible assets, much of it is not included in corporate balance sheets. Board members, managers, investors, and other stakeholders are increasingly aware of the significance of intangible assets, but they still desperately need solutions to this information gap.

Both the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA) advocate a new corporate reporting initiative, Integrated Reporting, which is championed by the International Integrated Reporting Council (IIRC).

Proponents making the case for integrated reporting believe it can give a much broader picture of the organisation due to its view of value beyond financial terms. It can, for instance, show how an organisation can achieve economic benefits and long-term growth by investing in initiatives to solve environmental or social issues.

Read more: 5 Necessary Steps in Developing Corporate Sustainability Performance ManagementWhat is an integrated report?

An integrated report should:

- Identify and communicate the full range of financial and non-financial factors that materially affect the ability of an organisation to create value over the short, medium and long-term.

- Recognise the importance of a broad range of capitals (financial, manufactured, intellectual, human, social and relationship and natural) to a thorough understanding of the organisation’s business model.

- Focus on the core concept of the business model to support integrated thinking and decision making with a view to sustainable value creation.

- Make the allocation of capital more efficient and productive through improvements in the quality of information available to providers of financial capital.

It is not a surprise that companies whose stakeholders have a broader and more long-term view are more likely to develop integrated reporting. For example, Eni, an Italian energy company, has turned to integrated reporting as a response to the demand of its key stakeholders for greater transparency regarding a series of environmental and sustainability issues.

“Although the numbers were allowing a true and fair review of the company’s performance, operations and management, they were not necessarily relevant to the stakeholders,” Sabina Ratti, Eni’s Sustainability Senior Vice President, said.

How integrated reporting benefits a company

Integrated reporting is gaining worldwide recognition but the journey has just begun. And the first step is for organisations to have a greater understanding of the positive impacts of integrated reporting.

Provide a better understanding of the value creation process

A company creates value through a series of interconnected value drivers, many of which are intangible. Integrated reporting provides a better understanding of the value creation process, and connects all factors of that process, both inside and outside the company.

Compared with traditional reporting, integrated reporting focuses more on the external environment. This is because changes in business strategy are more often driven by external factors than by internal activities. Integrated reporting helps a company to better identify, assess, and manage these factors.

The forward-looking nature of integrated reporting promotes intangible assets which tend to generate value in the long-term.

Read more: Improve These 5 Key Areas for Better Strategic DecisionsStrengthen the relationship with key stakeholders

Integrated reporting allows companies to disclose more relevant information needed by stakeholders, including information regarding intangible assets, in a clear and concise format.

Integrated reporting helps better explain of non-financial value to those investors who still fail to recognise the importance of intangible assets. It provides a framework for all relevant information about how a company create its value over time and provide a more holistic view of the company’s performance.

Ultimately, these benefits will allow the company and its stakeholders to make better short, medium and long-term decisions.

Improve capital allocation decision making

The connectivity of information provided by an integrated report enables a more efficient and productive capital allocation, both between businesses and within businesses.

English

English  Vietnamese

Vietnamese