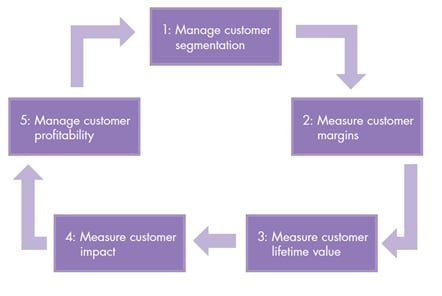

Just a quick reminder, in our previous blog entry, we have discussed about step 1 and 2 of the 5 steps. In this article, we continue to talk about the remaining steps that complete this circle of customer value management.

Step 3: Measure customer lifetime value (CLV)

A customer lifetime value is the present value of all future incoming flows associated with that specific customer. CLV model views the customers as company’s assets that generate revenues throughout the life of the relationship in which 3 essential components are considered in time periods:

- Profit: derived by gross profits and takes into account lifetime costs and revenues e.g. acquisition costs and growth in margins over time

- Retention rate: the rate at which the segment maintains their relationship with the company and continues future purchases

- Discount rate: the multiplier used to discount future profits to their present value and is often the after-tax cost of capital

How to calculate CLV:

- CLV is the sum of profits earned in time periods 1 through to the last period of the company deemed relevant for profitability analysis. The expected customers profit in each period is adjusted to reflect retention rate during the period and discounted to the present time period

Step 4: Measure customer impact

Profits gained from current or future revenues from customer segments are the most significant source of value. However, customers are always in control of whether value can be created or destroyed and these are outside the reach of customer lifetime value and other methods of assessing customer value. For example, customers can affect corporate profitability by owning value-generating or influencing perceptions and behaviours of others. The sources of influence include:

- Product referrals e.g. encouraging other customers to use the product if satisfied or dissuade others from buying the product if dissatisfied

- Possession of high levels of power or prestige e.g. serving as expert users, legitimating the product’s use for other customers

- Customers’ endorsement to products or services e.g. posting product reviews, providing tips and tricks for effective use of the products and solving problems for other customers

Step 5: Manage customer profitability

A company can improve overall profitability by developing a more complete picture of the values of a customer or a segment. In summary, strategies for managing customer profitability include:

- Managing customer profit margins:

- Re-price products and services

- Reduce customer costs

- Manage cost drivers

- Managing customer lifetime value:

- Improve retention and acquisition

- Upgrade customer profits

- Reduce lifecycle costs

- Measure, improve and manage customer satisfaction

- Managing customer impact

- Increase referrals

- Pursue influential customers

- Enhance data capture

- Increase customer participation

- Use data effectively

Since this is a closed-loop process, it is always recommended that companies use the experience gained from the first cycle and improve the next cycle - that is executing steps 1 to 5 more effectively.

For detailed discussion and application of the 2 steps, please read the CGMA Tools whitepaper “How to manage customer value (part 2)

***

This is the second articles of three articles in the series “Customer value creation”, don’t miss the final article of the same series on 22 Feb 2013: “How to create and derive more value from customers – A comprehensive example”

English

English  Vietnamese

Vietnamese