Strategic financial planning is crucial for business success. This article breaks down the steps to create an effective financial plan that supports your company's long-term goals.

Recent TRG blog posts

Rick Yvanovich

Recent TRG Blog Posts

A Comprehensive Guide to Conducting Strategic Financial Planning

Posted by Rick Yvanovich on Mon, Dec 23, 2024

Blog Topics: Financial consolidation, planning and reporting

Introducing CS Lucas Treasury Management Solution to the TRG Portfolio

Posted by Rick Yvanovich on Fri, Dec 6, 2024

We are thrilled to announce the addition of the CS Lucas Treasury Management System (TMS) to our financial solutions lineup. With its robust cash forecasting, payments, borrowing, and investment capabilities, this system is a natural fit alongside TRG International’s existing offerings, such as Infor SunSystems Cloud, Yooz, and Infor OS.

Blog Topics: News, TRG, Digital Transformation

AP Automation and ERP Systems: The Dynamic Duo

Posted by Rick Yvanovich on Fri, Dec 6, 2024

Enterprise resource planning (ERP) is a powerful solution with sophisticated modules, features, and functions. It connects various aspects of a business into a unified platform to provide a holistic view of its operations and performance. What you might not know is the solution can be integrated with additional systems like Accounts Payable Automation to expand its capabilities further.

Blog Topics: Financial Accounting Management Software, Digital Transformation

You're Losing Money on Manual Invoice Processing! Here's A Solution

Posted by Rick Yvanovich on Tue, Dec 3, 2024

86% of accounts payable teams rely on manual invoice processing1. This can cause businesses to lose money and human resources that could be used in more strategic areas.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Cash & Treasury Management Best Practices: A Comprehensive Guide for Finance Executives

Posted by Rick Yvanovich on Fri, Nov 29, 2024

Effective cash and treasury management stands as a cornerstone of corporate financial health. For finance executives, optimising these functions can significantly impact an organisation's liquidity, risk management, and overall financial performance.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Treasury Management in the Era of Digital Currencies

Posted by Rick Yvanovich on Thu, Nov 28, 2024

As digital currencies move from niche to mainstream finance, treasury teams face new opportunities and challenges. Beyond traditional tasks like managing liquidity and optimizing cash flow, treasurers must now consider these emerging assets. To succeed, they need to understand digital currencies and their impact on treasury operations.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

What to Look for in a Treasury Management Solution

Posted by Rick Yvanovich on Wed, Nov 27, 2024

Choosing the right software solution can make your treasury department run like a well-oiled machine. With countless options available, how do you find the perfect fit for your business? This article explores the key features and considerations when selecting a treasury management solution.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

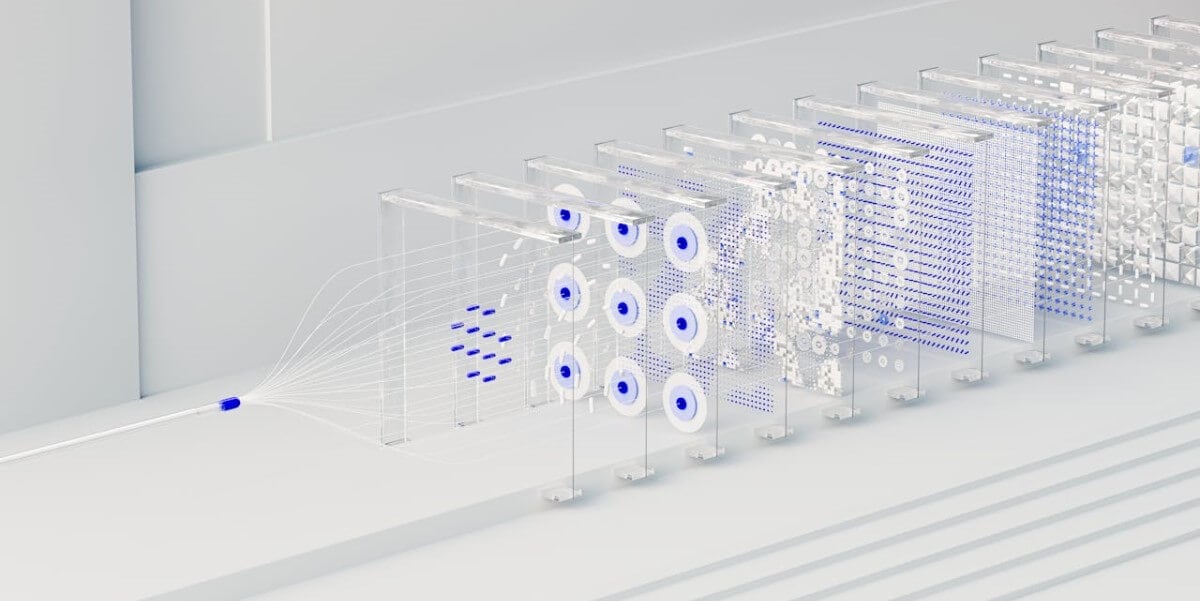

Hybrid Cloud Strategy Implementation: A Practical Guide for CIOs

Posted by Rick Yvanovich on Tue, Nov 26, 2024

This guide shows you how to build a hybrid cloud system. It follows up on our previous article about companies moving away from the cloud. A hybrid approach lets you use both cloud and local systems together. This gives you flexibility and keeps you secure. It also helps you follow regulations. However, you need to plan carefully to make all your IT systems work together.

Blog Topics: Technology trends, Cloud Computing

Long-term Financial Planning: How to Stay At Least 2 Steps Ahead

Posted by Rick Yvanovich on Fri, Nov 22, 2024

Anyone who plays chess knows a good player is not just thinking about their next move - they are planning several moves ahead. That is exactly what long-term financial planning is all about. It's not just about keeping the lights on today; it's about making sure your business is thriving three, five, or even ten years down the road.

Blog Topics: Financial consolidation, planning and reporting

Looking Beyond the Fiscal Year: How to Transition to Strategic Budgeting

Posted by Rick Yvanovich on Thu, Nov 21, 2024

An increasing number of businesses are looking beyond the fiscal year when it comes to budgeting, instead opting for strategic budgeting for good reasons. This article will explore these reasons and, more importantly, how your business can transition from traditional annual budgeting to strategic budgeting.

Blog Topics: Financial consolidation, planning and reporting

English

English  Vietnamese

Vietnamese