“The market for corporate performance management (CPM) suites continues to grow rapidly,” declared Gartner in its latest Magic Quadrant for CPM suites. Why? Gartner explains: “because CPM has helped to manage cost optimization efforts and is now increasingly employed in supporting growth-based strategies.”

That certainly was what led the AAA in west/central New York to opt for CPM from Prophix Software. “We’re able to provide our executive team with business information faster than ever before and do analysis on the information so they can see why something is up or down,” said Kristy Chapman, the auto club’s financial planning and reporting manager.Recent TRG blog posts

Corporate Performance Management Heats Up

Posted by Rick Yvanovich on Thu, Feb 2, 2012

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

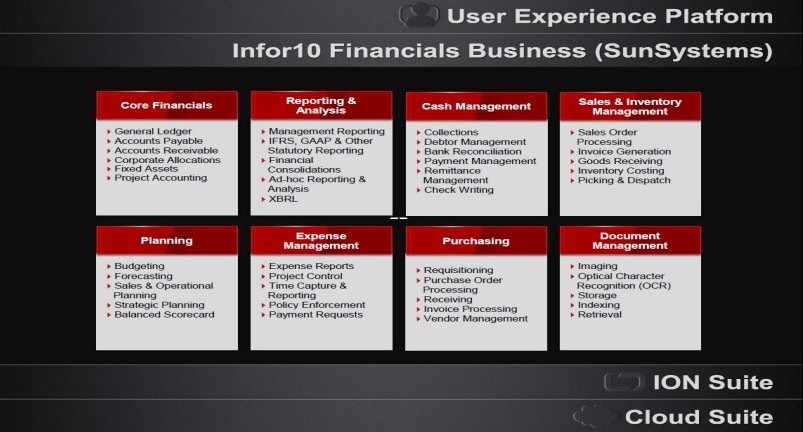

Infor SunSystems General Audience Campaign Ovum Tech Report

Posted by Rick Yvanovich on Tue, Jan 31, 2012

The financial management applications category is one of the most mature enterprise software sectors and the accounting application is one of the first tools that a growing company rolls out. In spite of its maturity and because of its indispensable nature, financial management tools need to continue evolving to meet the requirements of the business. It is essential, therefore, that the financial management tools of choice be supported by a successful vendor and a strong product management team.

Blog Topics: Financial consolidation, planning and reporting, IFRS, Financial Accounting Management Software, Infor SunSystems

Grow, Grow, Grow — or Sell, Sell, Sell? Breaking Down 2012 Financial Predictions

Posted by Rick Yvanovich on Tue, Jan 31, 2012

It’s that time of year again. As 2011 winds down, financial experts are hard at work trying to predict what 2012 will hold in store for U.S. small businesses. Will it be more of the economic slump we’ve seen for the past few years — or are things finally starting to turn around?

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

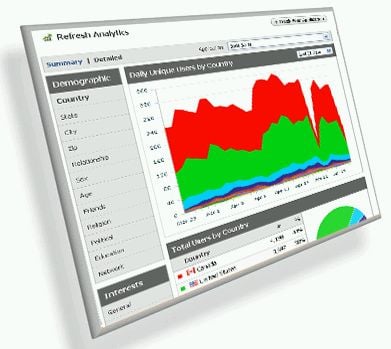

Analytics Can Make Finance More Relevant

Posted by Rick Yvanovich on Tue, Jan 31, 2012

Ventana Research recently completed groundbreaking benchmark research on how finance organizations use analytics these days. Of course, analytics have been a mainstay of finance organizations since people started using accounting ratios to assess the health and performance of a business. Yet perhaps because traditional analytics are so deeply entrenched, finance departments execute the basics well but don’t take the next step to fully utilize the power of information technology to use analytics more effectively. And they should: Our research finds that a majority of executives and managers outside the finance organization want the department to play a more strategic role in their company’s management.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Evaluating Financial Management Software: Five Must-Haves

Posted by Rick Yvanovich on Tue, Jan 31, 2012

The backbone of any organization, financial management applications are the foundation that helps a company manage and gain insight into the most important parts of their business. Financial management applications streamline processes to help an organization manage business-critical functions such as accounting, project management, payroll, and human resources. When the financial management software of an organization becomes disjointed or broken, the implications can certainly impact the success and profitability of that organization.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Evaluating Financial Management Software: Five Must-Haves

Posted by Thai Pham on Mon, Jan 30, 2012

The backbone of any organization, financial management applications are the foundation that helps a company manage and gain insight into the most important parts of their business. Financial management applications streamline processes to help an organization manage business-critical functions such as accounting, project management, payroll, and human resources. When the financial management software of an organization becomes disjointed or broken, the implications can certainly impact the success and profitability of that organization.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Business Success Comes from Financial Software

Posted by Thuy Tien Tran on Thu, Jan 19, 2012

Business leaders everywhere are looking for new ways to gain as much profit as possible. They look from all different angles to see the best approaches in order to better run their business.

Blog Topics: Financial consolidation, planning and reporting, IFRS, Financial Accounting Management Software, Infor SunSystems

The transition from GAAP to IFRS

Posted by Rick Yvanovich on Thu, Jan 19, 2012

Building business efficiencies and greater competitiveness for North American companies. Regulatory authorities are on track to make the International Financial Reporting Standards (IFRS) a requirement for all publicly-traded companies in the US, Canada, and Mexico over the next few years. For public companies in these countries, the transition to IFRS will be the most significant regulatory change in many years and one with potential to directly impact overall competitive position.

Blog Topics: Financial consolidation, planning and reporting, IFRS, Financial Accounting Management Software, Infor SunSystems

Business Analytics – Opposition or Proposition?

Posted by Rick Yvanovich on Thu, Jan 19, 2012

Metaphorically, belief and disbelief in business analytics as a competitive edge, and not just a passing fad, meet at a door. On one side is passion, and on the other, fear. Passion always lives with fear. Those with passion for a methodology, like embracing analytics to support decision, have fear that others will reject them and their ideas. What position for analytics will come out ahead? Opposition or proposition?

Technology is no longer the barrier to analytics

What is it about accepting a new idea like applying analytics? There is a lot. And it mainly has to do with the natural resistance to change with people. People like the status quo. The main barrier to the acceptance of applying analytics is no longer technical but rather is behavioral and cultural. The software tools are proven. The use of analytics by casual users, not just a team of trained statisticians, has become widespread.

Consider these remarks from Jane Griffin, a Principal with Deloitte Consulting LLP from a Deloitte “debate” on this topic:

“The executives I talk to every day are wrestling with business decisions where a better understanding of data at a very deep level can make all the difference. … Low-level analytics just won’t get you there. Work your way through the list of ground-shaking developments in business today – none are areas where companies can continue to shoot from the hip. Pricing. Workforce trends. Health reform. Even security and terrorism threats. These are all complex challenges where advanced signal detection capabilities are critical. … Analytics is no fad. It’s a serious competitive advantage.”

Analytics as the only sustainable competitive advantage

The popular Harvard Business School Professor Michael Porter’s defined accepted, generic strategies for a company (i.e., cost leadership, differentiation and focus), however they are all vulnerable today because competitors can more quickly take actions (such as reduce costs), imitate a company or invade a company’s market niche. An organization’s best defense against the competition is the ability to quickly make smart decisions – which can easily be accomplished by implementing business analytics. Organizations that achieve competency with business analytics are able to sustain a long-term competitive advantage.

A similar case can be made for adopting analytics-based enterprise performance management methodologies. The early adopters are already well ahead. Their executives have properly communicated their strategy to employees through appropriate key performance indicators (KPIs) and achievable targets to align behavior. They have robust predictive analytics that reduce uncertainty and allow them to take smarter and quicker actions. These organizations understand their cost and profit margins by product, service, channel and customer – as well as optimal actions needed to retain and grow customers, and acquire the best target customers. They have driver-based budgets and rolling financial forecasts using modeling techniques.

I suspect that passion (and common sense) was present to overcome fear of trying something new, like advanced analytics, to improve organizational performance.

Blog Topics: Talent Management, Financial consolidation, planning and reporting, Financial Accounting Management Software

Business Success Comes from Financial Software

Posted by Rick Yvanovich on Thu, Jan 19, 2012

Business leaders everywhere are looking for new ways to gain as much profit as possible. They look from all different angles to see the best approaches in order to better run their business.

Blog Topics: Financial consolidation, planning and reporting, IFRS, Financial Accounting Management Software, Infor SunSystems

English

English  Vietnamese

Vietnamese