In June 2015, Donald Trump, then the Republican front runner, threatened to slap a 35% tariff on Ford’s cars and trucks made in Mexico if the automaker went ahead with plans to move its production of small cars from the US to Mexico.

The feud between Mr. Trump and Ford was a highlight of his repeated pledges to bring manufacturing jobs back to the US. Mr. Trump also made it very clear that he opposes free trade agreements like TPP (Trans-Pacific Partnership) and will renegotiate NAFTA (the North American Free Trade Agreement).

Fast forward to 2017, Ford just announced on Jan 03 that it will cancel plans for the US$1.6 billion plant in Mexico and instead invest in expanding its facilities in Michigan, IL. And TPP is now dead in the water when both the White House and congressional leaders gave up on passing it.

Is reshoring, the practice of bringing outsourced production back to home countries, becoming a major trend that will reshape the future of global manufacturing? And should emerging economies be concerned?

The reshoring wave

Prior to Mr Trump’s upset in the 2016 election, there were signs of revived US manufacturing jobs. A study by the non-profit organisation Reshoring Initiative indicates that FDI investments and reshoring created 250,000 new jobs in the US manufacturing sector in 2015, which was on par with the number of jobs lost due to outsourcing.

Still, it has little effect on the long-term downward trend of manufacturing jobs in the US. The sector has lost 7 million posts from 1979. Meanwhile, the US trade deficit has skyrocketed and reached US$531 billion in 2015.

In a 2015 survey of executives at US-based manufacturers with at least US$1 billion in annual revenues, The Boston Consulting Group (BCG) consulting firm found that the US is the most preferred destination for adding manufacturing capacity, the position was held by China 2 years ago.

31% of respondents said their companies are most likely to increase their production capacity in the US within the next 5 years, as opposed to 20% said they plan to add capacity in China. In the same survey conducted 2 years earlier, the numbers were 26% and 30%, respectively.

Compared to the 2012 survey, the number of senior executives saying they are actively reshoring in the 2015 survey increased by 250%. Companies participated in the 2015 survey are nearly 3 times more likely to move production back to the US than to move from the US.

What is even more interesting is that the reshoring movement is mostly cost-driven. 70% of surveyed senior executives cited reduced shipping costs as a key reason for reshoring, while 76% cited shortened supply chain. In essence, the drivers of reshoring and outsourcing are very much the same.

As manufacturers continue to pay more attention to total cost, there are several factors that lead to outsourcing’s diminishing cost advantage:

Shrinking wage gap

Much lower labour costs in emerging economies like China and South East Asian countries have been a huge incentive for American manufacturers to outsource their production.

However, wages in these countries have been increasing at much faster paces than they have in America. In China, for instance, growing standards of living coupled with a strong yuan has caused manufacturing costs to go up 187% throughout the last decade compared to a growth rate of only 27% in the US.

Advantages of a shorter supply chain

Reshoring reduces or eliminates wastes associated with offshore production, for instance, transportation costs, overproduction due to large batch shipments, uncertain delivery and quality, unnecessary packing and unpacking, and extra inspection.

Additionally, reshoring improves cross-functional collaboration among designers, engineers, and shop floor workers, and eventually leads to accelerated time-to-market.

US manufacturing sector is increasingly attractive to not only US companies looking for opportunities to reshore but also foreign manufacturers realising the benefits of moving production closer to customers. One interesting aspect of this trend is Chinese manufacturers are now starting to open factories in the US.

Tianyuan Garment, for instance, is investing US$20 million to make clothes in Little Rock, Arkansas. Sun Paper Industry, a producer of paper products, opened its first factory in North America in South Arkansas last April. Chinese investors are also behind Lucid Motors and Faraday Future, the two Tesla-like electric vehicle startups that aim to produce their cars and SUVs in the US.

The cost of intellectual property theft

In a 2012 survey of members of the American Chamber of Commerce in China, more than 40% of respondents said the risk of data theft to their operation in China is rising. 48% reported that IP violations have caused material damage to their businesses, a steep increase from 18% in 2010.

The Commission on the Theft of American Intellectual Property of the U.S. International Trade Commission released a report in May 2013 stating that China accounts for 50% to 80% of US IP theft, and IP theft is costing hundreds of billions of dollar per year in losses. The report also concluded that “the longer the supply line, the more vulnerable it is to IP theft.”

The boosted US energy sector

Since the shale oil and gas boom started in the early 2000s, American manufacturers have been benefitting from cheaper energy produced domestically.

For energy-intensive industries, low energy prices have helped offset high labour costs and made America cost-competitive again. Lower fuel prices have driven down transportation costs while employment in the oil and gas operations as well as industries that support them has increased.

Much has been written about the rapidly growing American oil production that caused oil price to fall from over US$100 per barrel in July 2014 to less than US$50 in January 2015. But it was the preceding shale gas boom that signalled the renaissance of the US energy sector.

Thanks to the same innovations that were later introduced into shale oil production – most notably horizontal drilling and multi-stage hydraulic fracturing – US’s natural gas production surpassed Russia’s in 2009 to become the world’s largest natural gas producer, and has maintained this position since.

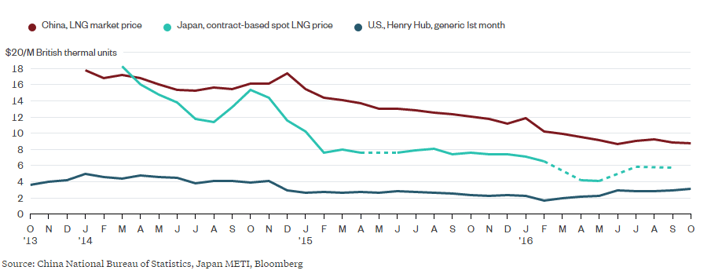

The natural gas prices in America are therefore much lower than those in Asia, Europe or South America. And among the biggest winners are manufacturers who use natural gas to produce chemicals, petrochemicals, steel, synthetic fabrics, fertilizer, and plastics.

A comparison of natural gas prices in China, Japan and the US

The role of advanced manufacturing technologies

In the aforementioned BCG report, 75% of respondents said they will “invest in additional automation or advanced manufacturing technologies in the next five years.” Such technologies are increasingly more affordable and levelling the playing field between US-based manufacturers and manufacturers in countries with lower labour costs.

Automation has long been a critical driving force behind increased productivity and reduced cost. Recent advancements in this field are making fully digitalised manufacturing a reality. Sometimes referred to as Industry 4.0, this new wave of disruptive technologies has already created major impacts on global manufacturing.

Read more: Manufacturers adapt to Industry 4.0

Last December, Adidas launched the world’s first-ever 3D-printed shoes that consumers can buy through a limited edition release at a reported price of US$333. The German sportswear giant now relies on over 1 million workers in 1,100 contract factories to make around 600 million units of sports shoes, clothing, and accessories a year. But now the company wants to move the production back to Germany, closer to its main markets.

Foxconn expects to use replace almost all human workers with robots in a three-phase plan. The giant Taiwanese manufacturer, which is famous for assembling Apple’s products, currently employs more than 1 million workers in mainland China alone. Of particular interest is the fact that Foxconn is making its own robots, called foxbots. The company set a target of 30% automation at its Chinese factories by 2020.

Read more: A new robotic revolution in manufacturing

The possibility of replacing a significant number of workers with 3D printers or robots makes a very compelling case for companies to move offshored operations back to their home countries.

Impact of Trump’s policies on the US manufacturing sector

During his campaign trail, Donald Trump has made promotion of domestic energy a centrepiece of his pro-growth economic policy. In particular, he has pledged to lift restrictions on the production of energy resources – oil, gas, and coal – and on energy infrastructure projects. Mr. Trump’ stance on this issue means American manufacturers are likely to continue to benefit from low energy prices in the foreseeable future.

Another key component of Mr. Trump’s business-friendly economic policy is tax reform. He has proposed to lower corporate income tax rate from 35% to 15%, which will give American companies a tax advantage over many European and Asian economies, and create more incentives to reshore.

Final remarks

While President-elect Trump’s rhetoric and proposed policies will almost certainly help accelerate the reshoring movement, for the most part, the underlying economic factors that determine where companies locate their production have remained the same.

However, technological advancements and changing business conditions have made manufacturing in emerging economies like China and South East Asian countries less cost-competitive. For these countries, relying on low labour costs is no longer sustainable. They must apply advanced manufacturing technologies and practices in order to be attractive outsourcing destinations.

Subscribe to our blog to stay informed with updates on advanced manufacturing technologies and practices.

English

English  Vietnamese

Vietnamese