Accounts payable, undoubtedly, plays a crucial role in the financial system of every company, making proper management essential for maintaining financial health. However, as businesses grow and thrive, manual AP procedures bring forth their fair share of challenges.

Recent TRG blog posts

Solving 5 Common Accounts Payable Issues with Automation

Posted by Rick Yvanovich on Mon, Jul 24, 2023

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software, Digital Transformation

Exploring Financial Management Solutions: An Overview of 6 Leading Software

Posted by Rick Yvanovich on Sat, Jul 1, 2023

Effective financial management plays a critical role in the success and long-term viability of organisations, regardless of their size or industry. The availability of advanced financial management software solutions has revolutionised the way businesses handle their financial operations, offering enhanced automation, real-time insights, and improved decision-making capabilities.

Blog Topics: Financial consolidation, planning and reporting, Enterprise Performance Management (EPM), Financial Accounting Management Software, Infor SunSystems

10 Key Questions for CEOs to Ensure Financial Management Implementation Success

Posted by Rick Yvanovich on Sat, Jun 17, 2023

A reliable financial management system will empower your business with accurate and timely information in one place. It will help you make informed decisions, develop effective financial plans, and stay compliant with regulations.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software, Infor SunSystems

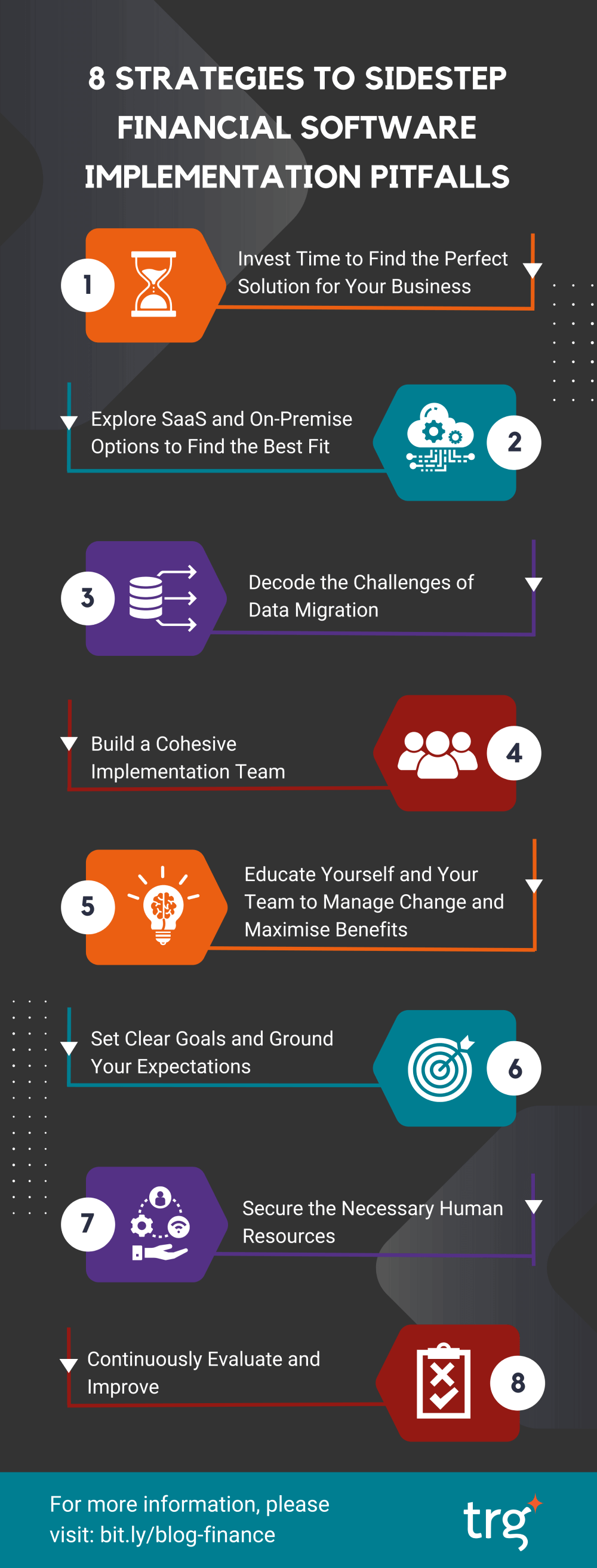

8 Strategies to Sidestep Financial Software Implementation Pitfalls (Pt.2)

Posted by Rick Yvanovich on Fri, Jun 9, 2023

In our previous blog post, we explored four strategies businesses should implement to avoid common mistakes in financial management software implementation. Today, we will uncover four additional strategies to help you and your business prepare effectively before embarking on your implementation journey.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

8 Strategies to Sidestep Financial Software Implementation Pitfalls (Pt.1)

Posted by Rick Yvanovich on Wed, Jun 7, 2023

Implementing a new financial management software system can be a game-changer for businesses, offering increased productivity, streamlined processes, and enhanced data accuracy and security. However, the road to successful implementation is not without its challenges and, if managed poorly, an implementation project may do more harm than good.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

The Role of Financial Planning in Recession-Proofing Your Business

Posted by Rick Yvanovich on Sat, Jun 3, 2023

In recent years, we have seen a whirlwind of unexpected changes, such as the fluctuation of cryptocurrency, the implementation of GDPR, the Brexit saga, and the China-US trade war. Adding to this, the recent pandemic has led to a global recession, making the world more volatile, uncertain, complex, and ambiguous than ever before.

Blog Topics: Financial consolidation, planning and reporting

An Overview of Key Features of Infor SunSystems Cloud

Posted by Rick Yvanovich on Wed, May 17, 2023

Your financial management system must have the ability to transcend borders, languages, and currencies at the same time. Access to critical real-time information whenever needed to make informed business decisions.

Blog Topics: Financial consolidation, planning and reporting, Infor SunSystems

Newsflash: Financial skills aren’t enough for a finance professional

Posted by Rick Yvanovich on Thu, Oct 27, 2022

After the severe pandemic and its subsequent economic meltdown, the role of finance professionals within organisations has been in the spotlight. Companies need more finance leaders with core financial skills to manage risk, cash flow and cost control.

Blog Topics: Talent Management, Financial consolidation, planning and reporting, Digital Transformation

IFRS 17 Overview: What Is It For? Who Is Affected? Why Should You Care?

Posted by Rick Yvanovich on Tue, Aug 16, 2022

International Financial Reporting Standard IFRS 17 was issued on 18 May 2017 by the International Accounting Standards Board.

Blog Topics: Financial consolidation, planning and reporting, Business Intelligence, Analytics

Budgeting Challenges Facing the Oil and Gas Industry

Posted by Rick Yvanovich on Fri, Jul 1, 2022

As the world continues to move towards renewable energy, the oil and gas industry will face increasingly steeper technical, operational, and organisational challenges. Having a streamlined budgeting process is among the most daunting ones.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

English

English  Vietnamese

Vietnamese