For a company located at a single site, the decision to upgrade or transition to a new financial management solution is relatively straightforward. Organisational systems and employees are all conveniently located under one roof, and the decision-making process is a linear journey.

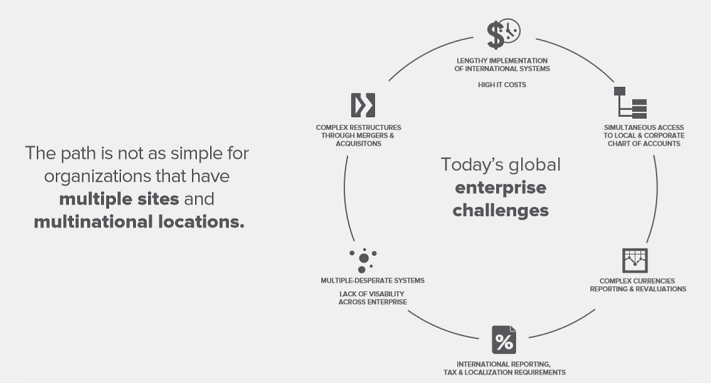

But the path is not as simple for organisations that have multiple sites and multinational locations. In an economic climate characterised by mergers and acquisitions, joint ventures, and exponential growth, this structure is becoming more the norm than the exception. IT professionals in complex organisations know they must have a robust solution to meet the demand for consolidated enterprise-wide financial systems.

Read more: SAP vs. Infor – Software Giants Face Off Over Cloud Strategy

To combat these issues, an alternative approach–known as a “two-tier” financial strategy–is being pursued by an increasing number of organisations. With a two-tier strategy, businesses don’t view their headquarters and all subsidiaries or divisions as a collective whole when it comes to choosing financial management technology. Instead, they take into account the level of functionality required by various locations, as well as the operational capabilities that exist across the company. The result is the identification of multiple systems capable of meeting diverse needs but also (importantly) able to work easily together. To keep complexity in check, most organisations settle on two options–one for headquarters or larger divisions and a second for smaller locations that do not warrant a full ERP implementation.

Read more: [Infographic] 4 Signs that It’s Time to Upgrade Your ERP System

While implementing different financial management systems across the business may seem counterintuitive to CFOs in pursuit of a consolidated view of operations, it’s important to understand that one does render the other impossible. Thanks to advancements in integration technology and within financial management solutions themselves, concerns about visibility that would have scuttled a two-tier strategy in years past are less of an issue today. Organisations are increasingly finding that the two-tier approach actually reduces complexity, while delivering benefits such as:

- Lower total cost of ownership—A two-tier approach allows companies to pay for the level of solution required by various locations, rather than undertaking a full ERP implementation in every instance.

- Greater flexibility and agility—As mentioned above, implementing multiple solutions no longer implies organisational chaos. Different solutions can integrate and co-exist seamlessly, thereby eliminating operational silos while also increasing efficiency.

- Faster implementation and reduced training requirements—Full ERP implementations can be lengthy and expensive. Using a smaller niche solution where appropriate allows businesses to implement and deploy financial management technology in less time and also bring new locations online at a much faster rate. Because these solutions are less complex, training requirements are also usually reduced, allowing staff to get up to speed and productive quickly.

- Improved risk management—As organisations grow and become more global in nature, the complexity of regional compliance and risk management increases. A two-tier strategy means that companies can implement solutions that offer global financial management capabilities and ease of deployment where needed. The complexity of staying in compliance and the risks associated with failing to meet requirements are both reduced as a result.

- Increased visibility—When care is taken to select systems that can integrate well with each other, a two-tier strategy typically provides a greater level of visibility across the business because each location has technology suited to its particular needs.

Finding the right two-tier solution

There are many choices when it comes to financial management technology; and while finding the right vendors takes time, the process should not be rushed, as the choice will have long-term implications for overall business health. While the needs of each organisation will vary greatly, the following criteria should be considered essential:

- Integration—Integration is absolutely critical for making any two-tier strategy effective and should be among the first questions organisations ask. Vendors should be able to demonstrate how their technology has been integrated with ERP solutions from other providers in the past—either by using the vendor’s own integration technology, working with outside middleware providers, or teaming up with customers’ IT staffs to advise on internally driven initiatives. Integration is key not only to achieving visibility across the enterprise but also to make the most of both existing and future technology investments.

- Multinational capabilities—Robust global financial management capabilities are obviously a must for organisations that operate outside their own borders but are also critical for any company that may expand internationally in the future. In today’s global marketplace, that now includes nearly everyone. Key functionality to look for includes multi-currency, multi-location, and multi-language capabilities; localised reporting; accommodation for multiple reporting calendars; and support for local regulatory requirements. Anytime, anywhere access to support in multiple languages is also critical.

- Industry-specific solutions—Larger and more complex ERP solutions will often be presented as offering industry-specific capabilities; but in many cases, they haven’t truly been designed with a particular industry in mind. Reality often fails to meet expectations as a result. A two-tier strategy gives organisations the freedom to choose best-in-class solutions that address unique needs where needed without a high degree of customisation–an approach that is more sustainable and cost-effective over the long term.

- Flexible deployment options—A major benefit of the two-tier approach is the ability to accommodate varying degrees of IT infrastructure and skill found at diverse business units, so flexibility when it comes to deployment is absolutely essential. Some locations may not have the equipment or skills to support an on-premise deployment. Others may be in areas where cloud deployment isn’t yet viable. Vendors must be able to support the conditions “on the ground” for a two-tier strategy to pay off.

The bottom line? Rather than adding complexity to financial operations by introducing multiple systems into an organisation, a two-tier approach can provide both visibility and flexibility. For complex enterprises, it puts power back into hands of financial and IT professionals who are in the best position to understand their own needs, rather than shackling the entire organisation to a single provider. Business agility, risk management, and cost control can all be dramatically improved as a result.

Read more: Infor - the Enterprise Software Giant from New York City

Saugatuck Technology predicts that through 2016, “hybrid” cloud deployments, such as two-tier ERP, will become the enterprise platform of choice, with at least three-quarters of new enterprise IT spending involving hybrid or cloud platforms. Bruce Guptill, Alex Bakker, Charlie Burns, Mike West, Bill McNee, “2012 Cloud Business Solution Survey: Summary Data Report,” Saugatuck Technology, March 21, 2012.

For financial executives at multi-site and/ or multinational businesses, a two-tier approach to deploying financial management solutions across the enterprise is worth evaluating as it can provide:- Technology that meets the needs of divisions large or small, complex or simple–without sacrificing visibility or efficiency.

- A more cost effective approach that shortens implementation times and speeds time to value.

- An opportunity to benefit from the comprehensive functionality and scalability provided by larger ERP solutions while also taking advantage of best-of-breed offerings.

Like what you have read? Subscribe to our TRG Blog to keep up-to-date with the latest information in the industry. Or maybe you're interested in getting to know more about ERP implementations? Download our whitepaper and find out now!

English

English  Vietnamese

Vietnamese