2012 has been a tough year for many businesses. Managers have to struggle to make sure their organisations survive and stay strong through these difficult times. As a result, costs and budgets have become the most important factors to consider when making an investment decision. A strong budget can help managers know when they have a steady stream of cash flow and make better decisions based on that budget information. Here are a few tips for managers to weather the tough times:

Recent TRG blog posts

Small tips to improve the budgeting process

Posted by Thai Pham on Fri, Nov 30, 2012

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

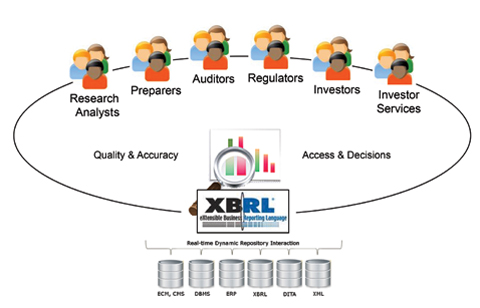

Three Things You Need to Know About XBRL

Posted by Cuong Nguyen on Wed, Nov 28, 2012

Spring is not too far away, and with the change of seasons comes a change in the financial reporting requirements. XBRL (eXtensible Business Reporting Language) mandates go into effect April 13, when the SEC (US Securities and Exchange Commission) will require the 500 largest public companies to file XBRL-tagged versions of their financial results. By 2013, all public companies which use International Financial Reporting Standards (IFRS) will also be submitting their financial returns to the SEC using XBRL.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

Cause-effect visibility from planning & budgeting solutions

Posted by Thanh Nguyen on Tue, Oct 16, 2012

You have a plan. You have a budget that supports it. Only one thing is missing: a way to easily view and analyse the cause-and-effect relationships between all the plan elements and the resources that support them. Not having this is a common complaint among senior executives who are responsible for managing and reporting on the execution of corporate strategy.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

Cause-effect visibility from planning & budgeting solutions

Posted by Thuy Tien Tran on Tue, Oct 16, 2012

You have a plan. You have a budget that supports it. Only one thing is missing: a way to easily view and analyse the cause-and-effect relationships between all the plan elements and the resources that support them. Not having this is a common complaint among senior executives who are responsible for managing and reporting on the execution of corporate strategy.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

What to look for in corporate budgeting solutions

Posted by Nhi Huynh on Wed, Oct 10, 2012

When it comes to budgeting, the traditional method used is spreadsheets. However, over the years, spreadsheets have demonstrated themselves to be insufficient to handle budgeting in the ever changing business world. Hence, dedicated corporate budgeting solutions were born to deliver the accuracy, agility and responsiveness that companies so desire. A powerful budgeting solution should help businesses adopt budgeting best practices, such as:

Blog Topics: Planning and Budgeting, Talent Management, Financial consolidation, planning and reporting, Financial Accounting Management Software

What to look for in corporate budgeting solutions

Posted by Nhi Huynh on Wed, Oct 10, 2012

When it comes to budgeting, the traditional method used is spreadsheets. However, over the years, spreadsheets have demonstrated themselves to be insufficient to handle budgeting in the ever changing business world. Hence, dedicated corporate budgeting solutions were born to deliver the accuracy, agility and responsiveness that companies so desire. A powerful budgeting solution should help businesses adopt budgeting best practices, such as:

Blog Topics: Talent Management, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM), Financial Accounting Management Software

Making the case for specialised financial close software

Posted by Rick Yvanovich on Fri, Oct 5, 2012

In 2010, Aberdeen Group carried out a study, which shows the graded popularity of standalone consolidation/reporting tools and consolidation/reporting tools included in ERP systems among best-in-class, industry average and laggard companies. The results indicate that standalone or specialised financial reporting and consolidation tools (71%) were preferred over consolidation features included in ERP applications (37%) by best-in-class companies.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Financial Accounting Management Software

Step-by-step guide to budget and strategy alignment

Posted by Thai Pham on Tue, Oct 2, 2012

Given the strategic planning best practices, it is obvious that the creation of a good plan requires far more than just collecting a set of financial estimates. To achieve a budget and strategy alignment, use the following six steps:

Blog Topics: Planning and Budgeting, Talent Management, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

Step-by-step guide to budget and strategy alignment

Posted by Thai Pham on Tue, Oct 2, 2012

Given the strategic planning best practices, it is obvious that the creation of a good plan requires far more than just collecting a set of financial estimates. To achieve a budget and strategy alignment, use the following six steps:

Blog Topics: Planning and Budgeting, Talent Management, Financial consolidation, planning and reporting, Enterprise Performance Management (EPM)

3 Common Approaches to Book closing and Financial Consolidation

Posted by Rick Yvanovich on Fri, Sep 21, 2012

Depending on their situation and strategies, companies approach the financial consolidation process in different ways. It is important that businesses thoroughly understand their choices so as to achieve an efficient financial close. The main approaches, some of which may be combined, are discussed below.

Blog Topics: Planning and Budgeting, Financial consolidation, planning and reporting, Financial Accounting Management Software

English

English  Vietnamese

Vietnamese