In previous blog posts, we have discussed why workflow automation software is a worthwhile investment as it frees up human resources, increases efficiency, reduces errors in both information gathering and overall processes, and reduces your overall costs.

Recent TRG blog posts

What to Look For in Workflow Automation Software

Posted by Rick Yvanovich on Fri, Oct 4, 2019

Blog Topics: Enterprise Performance Management (EPM), Financial Accounting Management Software, Business Intelligence, Analytics

What to Look For In a Document Management System

Posted by Rick Yvanovich on Thu, Oct 3, 2019

As we have explained in earlier blog posts, proper document management is a challenging but worthwhile practice. However, if you have decided to invest in a document management system (DMS), a whole new problem arises – Which one do you choose and what does such a system even need?

Blog Topics: Enterprise Performance Management (EPM), Financial Accounting Management Software, Business Intelligence, Analytics

5 Best Practices for Financial Planning In a VUCA World

Posted by Rick Yvanovich on Mon, Sep 30, 2019

A typical finance professional spends the majority of his or her time collecting, validating, and administering data, leaving a tiny window for value-added analysis. CFOs demand forecasts to be accurate, timely, and relevant. Yet, the finance department struggles to satisfy such requests.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software

What Does the Future Hold for Financial Forecasting?

Posted by Rick Yvanovich on Thu, Sep 19, 2019

As planning, budgeting and forecasting become indispensable strategic contributors, finance executives begin to realise the need to transform their rigid yearly financial planning by adopting more advanced (both on-premise and cloud-based) analytical tools. 71 per cent of organisations surveyed by FSN in 2017 has been able to reforecast more than twice a year, up from 56 per cent in the previous year, although the forecasting accuracy is still fairly low.

Blog Topics: Financial consolidation, planning and reporting, Financial Accounting Management Software, Cloud Computing, Analytics

How Infor SunSystems 6.4 Can Supercharge Your Digital Transformation

Posted by Rick Yvanovich on Sun, Sep 15, 2019

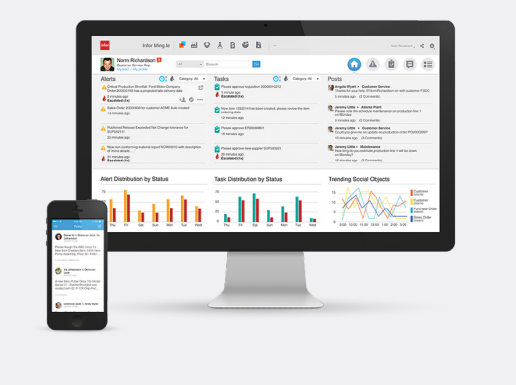

Infor SunSystems 6.4 is not just a new version of the venerable accounting system, it represents a quantum leap in enterprise software. Fully packed with capabilities far beyond what a traditional financial management suite can deliver, Infor SunSystems 6.4 can be the catalyst for your business’ digital transformation.

Blog Topics: Financial Accounting Management Software

Must-Have Features of Accounting Software for Hospitality

Posted by Andrew Turton on Fri, Sep 13, 2019

Hospitality faces unique challenges and has specific requirements, making conventional accounting systems unfit for this industry.

Blog Topics: Hospitality solutions, Financial consolidation, planning and reporting, Financial Accounting Management Software

7 Things You May Not Have Known about Infor SunSystems 6.4

Posted by Rick Yvanovich on Mon, Sep 9, 2019

Infor SunSystems 6.4 is one of the most prominent Infor products hosted in the cloud but you already knew that. What you may not have known is that SunSystems 6.4 is not just a new version of the venerable accounting software. In many ways, it represents a quantum leap in business solutions. Here are 7 interesting facts about SunSystems 6.4 to blow you away!

Blog Topics: Financial Accounting Management Software

8 Do’s & Don’ts in Cloud Accounting Software Implementation

Posted by Rick Yvanovich on Mon, Sep 9, 2019

If you are reading this article, chances are, you are looking to upgrade your current accounting software due to:

Blog Topics: Financial Accounting Management Software, Cloud Computing

Making the Case for a Cloud Expense Management Solution

Posted by Thai Pham on Mon, Aug 19, 2019

As you are well aware, expense management is an integral part of many businesses. This normally involves employee travel and entertainment expenses. Yet Aberdeen Report found that 53 per cent of businesses are still managing their travel expenses manually; gone should be days of manually reporting expenses. It is both a demanding and potentially risky process. All this time wasted, used energy and risk of resources can be regained with the use of cloud-based expense management systems.

Blog Topics: Financial Accounting Management Software

5 Things You Should Know Before Adopting Beyond Budgeting

Posted by Rick Yvanovich on Sun, Aug 18, 2019

Over the years the Beyond Budgeting movement has made it much more obvious that businesses should rethink budgeting; how the process works and how it should be utilised. Nonetheless, this new management model is not for everyone despite its advantages. Here are 5 things you should consider before adopting beyond budgeting.

Blog Topics: Financial Accounting Management Software

English

English  Vietnamese

Vietnamese